Following the recent announcement of Durasert’s triumphant results in the second Phase III trial, pSivida immediately submitted a marketing authorisation application (MAA) to the European Medicines Agency (EMA) to seek European approval for the company’s lead eye product in posterior segment uveits. A US Food and Drug Administration (FDA) filing is also scheduled for Q4 2017.

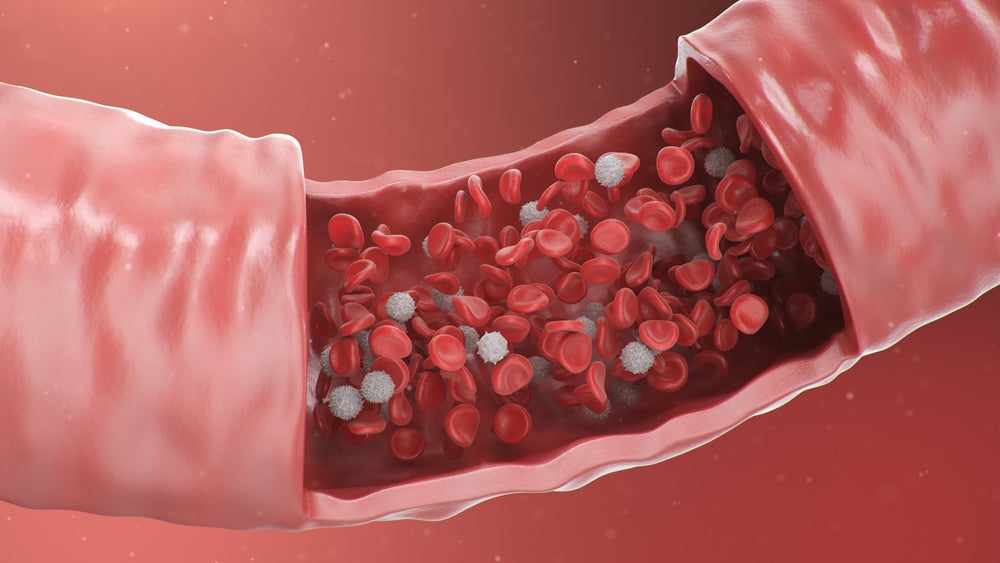

Formerly known as Medidur, Durasert is an injectable micro-insert that is injected into the back of the eye and provides sustained release of fluocinolone acetonide directly to the retina at a controlled rate for three years. Topline results from a second Phase III study involving 153 patients showed that Durasert hit its primary endpoint of preventing recurrence of posterior uveitis at six months, with patients continuing to be followed for 36 months, according to pSivida’s press release.

However, Durasert patients experienced higher intraocular pressure (IOP) elevations when compared with the sham cohort and a higher proportion of Durasert patients required IOP-lowering therapy at some time during the first six months.

The use of ocular steroid implant in uveitis patients is not a novel idea. A similar technique was used in Retisert, which was also developed by pSivida based on its Medidur platform. In addition, Ozurdex was developed by Allergen using the polymer drug delivery system, with approval in the US and EU in 2011. However, key opinion leaders (KOL) interviewed by GlobalData believe that this single, in-office injection of Durasert, compared to the other two ocular implants, is more convenient to handle and could also greatly improve patient compliance.

Durasert also has a longer duration of action, lasting for three years via a single injection compared to 30 months and six months in Retisert and Ozurdex, respectively. Long-acting therapy is always regarded as a major unmet need in uveitis treatment. Given the promising long-acting duration of Durasert, some KOLs are envisaging an increasing proportion of patients for this newcomer. GlobalData believes it is likely to steal market share from its competitors.

Lingering concerns over the actual efficacy and safety of Durasert have been constantly expressed by KOLs. On one side, Durasert delivers a smaller dose of the drug (0.18mg fluocinolone acetonide) than its competitors Retisert (0.59mg fluocinolone acetonide) and Ozurdex (0.7mg dexamethasone acetate). Complications such as glaucoma and cataracts have been well-known among patients receiving corticosteroid implants over time and whether Durasert would bring fewer adverse effects is yet to be confirmed. Consequently, GlobalData believes that these additional factors will greatly influence the uptake and the success of Durasert.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

European Medicines Agency (UK)

EyePoint Pharmaceuticals Inc

Food and Drug Administration Iran

MAA, Inc.