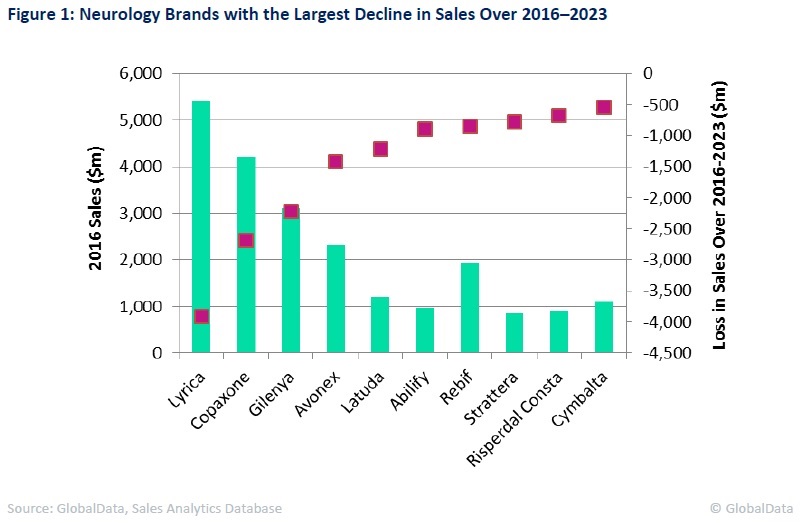

Despite significant sales contribution from recently launched neurology brands, which aid the overall expansion of this market going forward, the market is expected to lose $28.7 billion by 2023 due to the patent expiration of numerous brands.

Ten brands illustrated in the figure below will be responsible for 53% of these losses collectively. Seven of these are currently blockbuster brands.

With several approvals achieved, Pfizer’s Lyrica is the highest-selling brand in neurology, with $5.4 billion in sales in 2016. As a result, it will attract the most generic competition and see the most rapid sales erosion within this field. In Europe, Lyrica’s patent for the treatment of epilepsy and generalised anxiety disorders expired in July 2014, allowing generics to enter this market.

With several approvals achieved, Pfizer’s Lyrica is the highest-selling brand in neurology, with $5.4 billion in sales in 2016. As a result, it will attract the most generic competition and see the most rapid sales erosion within this field. In Europe, Lyrica’s patent for the treatment of epilepsy and generalised anxiety disorders expired in July 2014, allowing generics to enter this market.

Pfizer's patent for the treatment for neuropathic pain remains valid, however, and is set to expire in July 2017. In the US, the company hasw won a court ruling that will block any generic versions of Lyrica for any of its approved indications until December 2018, when its patents expire in the country. From this date onward, Lyrica is expected to see a sharp fall in sales due to fierce generic erosion. This brand is therefore forecast to lose $3.9 billion in sales by 2023.

A similar case is provided by Teva’s Copaxone, the second highest-selling brand within neurology according to 2016 sales. In January 2017, the US District Court invalidated four patents covering Copaxone 40mg/ml, the thrice-weekly version of the original 20mg/ml formulation that is administered once daily for multiple sclerosis patients.

See Also:

This original drug had already lost patent protection in 2015. In an effort to soften the impact of generic erosion and protect its key franchise, Teva switched patients to the 40mg/ml formulation, driven by its discounted price, improved convenience, and a targeted marketing strategy. However, generic entry for its 40mg/ml formulation comes much earlier than anticipated, as its patents were scheduled to expire in 2030. Consequently, the Copaxone franchise is forecast to lose $2.7 billion in sales by 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAnother multiple sclerosis brand, Novartis’ Gilenya, will experience generic competition from 2019 onward, despite the company’s attempts to salvage the brand’s 2026 patent. Being approved as the first oral multiple sclerosis drug, Gilenya rapidly positioned itself in this market, currently ranked as the fourth highest-selling brand in neurology. However, given the looming generic entry, this brand is expected to lose $2.2 billion in sales by 2023.

Despite the multitude of strategies that can be employed to halt or delay the entry of generic competition, sales erosion remains inevitable, especially in a market such as neurology, where small molecules are the mainstay.