The pharmaceutical industry continues to be a hotbed of patent innovation. Activity is driven by the evolution of new treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 787,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on Innovation in pharma: attenuated virus-based vaccines. Buy the report here.

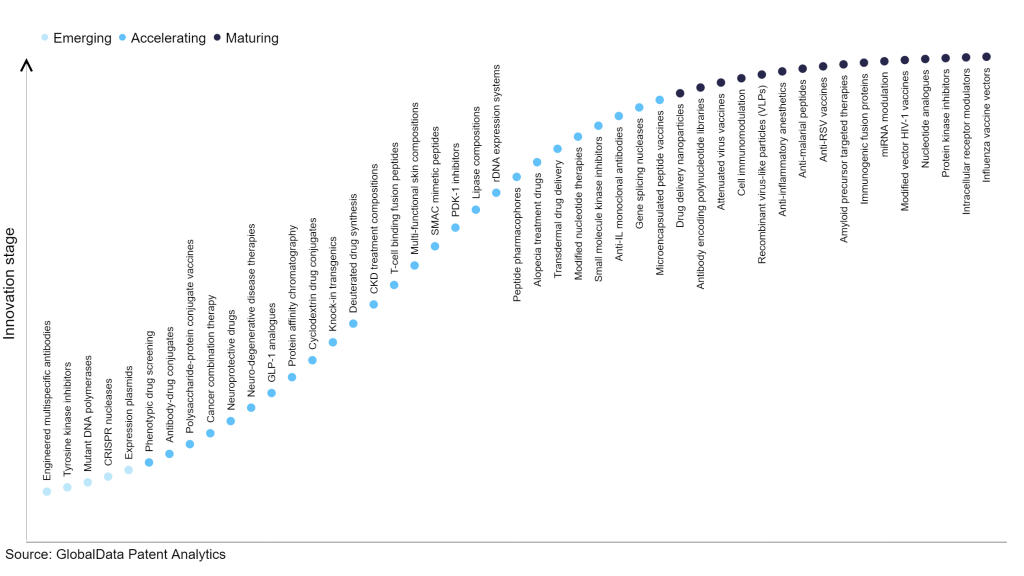

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 668,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, engineered multispecific antibodies, tyrosine kinase inhibitors, and mutant DNA polymerases are disruptive technologies that are in the early stages of application and should be tracked closely. Phenotypic drug screening, antibody-drug conjugates, and polysaccharide-protein conjugate vaccines are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are drug delivery nanoparticles and antibody encoding polynucleotide libraries, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

Attenuated virus-based vaccines is a key innovation area in the pharmaceutical industry

A live-attenuated vaccine uses a living but weakened version of a virus or bacteria with reduced virulence. Live-attenuated vaccines help in preventing infection by creating a strong and long-lasting immune response without causing serious disease in people with healthy immune systems

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50+ companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of attenuated virus-based vaccines.

Key players in attenuated virus-based vaccines – a disruptive innovation in the pharmaceutical industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to attenuated virus-based vaccines

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Merck & Co Inc | 105 | Unlock Company Profile |

| US Department of Health and Human Services | 72 | Unlock Company Profile |

| Sanofi | 70 | Unlock Company Profile |

| Valneva SE | 55 | Unlock Company Profile |

| C. H. Boehringer Sohn AG & Co KG | 53 | Unlock Company Profile |

| Zoetis Inc | 38 | Unlock Company Profile |

| Centre National Research Scientific | 27 | Unlock Company Profile |

| South Dakota Board Of Regents | 20 | Unlock Company Profile |

| Takeda Pharmaceutical Co Ltd | 20 | Unlock Company Profile |

| GSK plc | 19 | Unlock Company Profile |

| Sementis Ltd | 18 | Unlock Company Profile |

| The United States Of America | 17 | Unlock Company Profile |

| Najit Technologies Inc | 14 | Unlock Company Profile |

| Pfizer Inc | 13 | Unlock Company Profile |

| Bharat Biotech Ltd | 13 | Unlock Company Profile |

| Johnson & Johnson | 13 | Unlock Company Profile |

| Codagenix Inc | 12 | Unlock Company Profile |

| U.S. Department of Defence | 12 | Unlock Company Profile |

| Centre National de la Recherche Scientifique | 12 | Unlock Company Profile |

| Department Of Primary Industries And Fisheries | 11 | Unlock Company Profile |

| Laboratorios Hipra SA | 8 | Unlock Company Profile |

| Health Protection Agency | 7 | Unlock Company Profile |

| Stichting Tech Wetenschapp | 7 | Unlock Company Profile |

| Orbis Health Solutions LLC | 7 | Unlock Company Profile |

| Toray Industries Inc | 6 | Unlock Company Profile |

| Department of Health & Social Care | 6 | Unlock Company Profile |

| Ramot | 6 | Unlock Company Profile |

| Consejo Superior Investigacion | 6 | Unlock Company Profile |

| Intervet | 5 | Unlock Company Profile |

| The U.S. government | 5 | Unlock Company Profile |

| RAD BioMed Ltd | 5 | Unlock Company Profile |

| Oswaldo Cruz Foundation | 5 | Unlock Company Profile |

| St. Jude Children’s Research Hospital Inc | 4 | Unlock Company Profile |

| INST NATIONAL RECHERCHE AGRONOMIQUE | 4 | Unlock Company Profile |

| Viracine Therapeutics Corporation | 4 | Unlock Company Profile |

| Fundacao Oswaldo Cruz-Fiocruz | 4 | Unlock Company Profile |

| Precigen Inc | 4 | Unlock Company Profile |

| Meat & Livestock Australia Ltd | 3 | Unlock Company Profile |

| Ycine LLC | 3 | Unlock Company Profile |

| U.S. Department of Agriculture | 3 | Unlock Company Profile |

| Triad National Security, LLC | 2 | Unlock Company Profile |

| Spanish National Research Council | 2 | Unlock Company Profile |

| Bavarian Nordic AS | 2 | Unlock Company Profile |

| PAH USA 15 LLC | 2 | Unlock Company Profile |

| Utilities Service Alliance | 2 | Unlock Company Profile |

| Bio Poa Co Ltd | 2 | Unlock Company Profile |

| Novartis AG | 1 | Unlock Company Profile |

| National Dairy Development Board | 1 | Unlock Company Profile |

| US Department of Energy | 1 | Unlock Company Profile |

| CSL Ltd | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Merck is the leading patent filer for attenuated virus-based vaccines. It has several marketed assets for measles, mumps, and rubella. Merck is also developing a product for cytomegalovirus (HHV-5) infections based on an attenuated virus. Apart from the above asset, the company has also filed patents for new developments based on attenuated vaccines.

In terms of application diversity, Stichting Tech Wetenschapp is the top company, followed by Oswaldo Cruz Foundation and Fundacao Oswaldo Cruz-Fiocruz. By means of geographic reach, Valneva holds the top position, while Sementis and Merck are in second and third positions, respectively.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.