The pharmaceutical industry continues to be a hotbed of patent innovation. Activity is driven by the evolution of new treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 787,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on Innovation in pharma: CKD treatment compositions. Buy the report here.

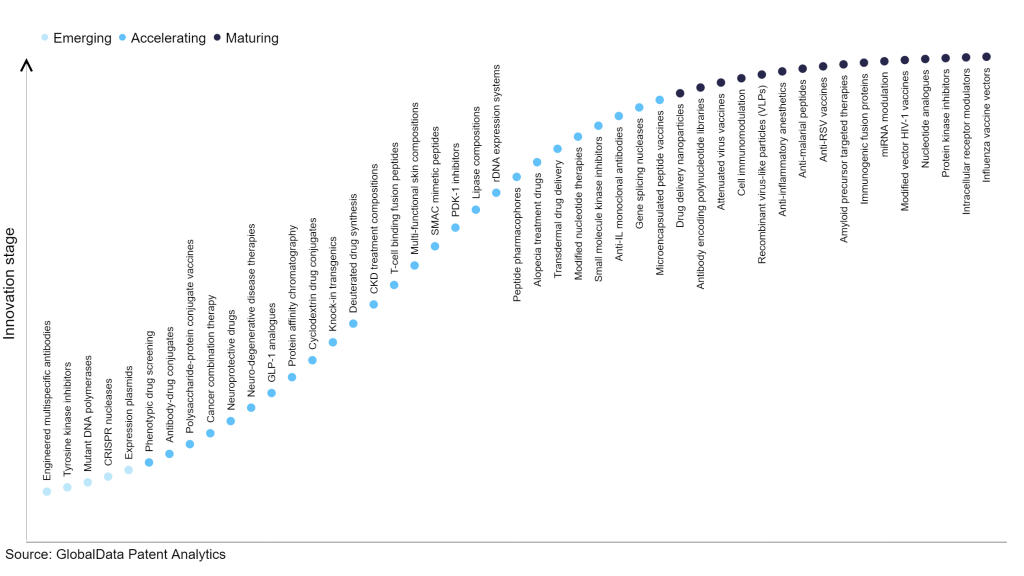

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 668,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, engineered multispecific antibodies, tyrosine kinase inhibitors, and mutant DNA polymerases are disruptive technologies that are in the early stages of application and should be tracked closely. Phenotypic drug screening, antibody-drug conjugates, and polysaccharide-protein conjugate vaccines are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are drug delivery nanoparticles and antibody encoding polynucleotide libraries, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

CKD treatment compositions is a key innovation area in pharmaceutical

Chronic kidney disease (CKD) or chronic renal disease is a condition characterised by a gradual loss of kidney function over time. Diabetes and high blood pressure are the most common causes of kidney disease. Treatments include high blood pressure medications such as angiotensin-converting enzyme (ACE) inhibitors or angiotensin II receptor blockers to preserve kidney function, medications to relieve swelling etc.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 70+ companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of kidney disorder treatment compositions.

Key players in CKD treatment compositions – a disruptive innovation in the pharmaceutical industry industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to CKD treatment compositions

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Boston Medical Center | 50 | Unlock Company Profile |

| Compagnie Merieux Alliance | 45 | Unlock Company Profile |

| AstraZeneca | 39 | Unlock Company Profile |

| Massachusetts General Hospital | 39 | Unlock Company Profile |

| Idexx Laboratories | 36 | Unlock Company Profile |

| Sanofi | 36 | Unlock Company Profile |

| Biogen | 34 | Unlock Company Profile |

| Kirin | 33 | Unlock Company Profile |

| MyCartis | 25 | Unlock Company Profile |

| Proteomics International Laboratories | 24 | Unlock Company Profile |

| Colgate-Palmolive | 19 | Unlock Company Profile |

| AbbVie | 19 | Unlock Company Profile |

| CareGroup | 17 | Unlock Company Profile |

| St Vincent’s Health Australia | 14 | Unlock Company Profile |

| Renibus Therapeutics | 14 | Unlock Company Profile |

| Immundiagnostik | 13 | Unlock Company Profile |

| OPKO Health | 13 | Unlock Company Profile |

| General Hospital | 13 | Unlock Company Profile |

| PerkinElmer | 12 | Unlock Company Profile |

| Pieris Pharmaceuticals | 12 | Unlock Company Profile |

| Mars | 12 | Unlock Company Profile |

| Mount Sinai Health System | 11 | Unlock Company Profile |

| Leadgene Biomedical | 11 | Unlock Company Profile |

| 4TEEN4 Pharmaceuticals | 10 | Unlock Company Profile |

| Yaqrit | 10 | Unlock Company Profile |

| Tricida | 9 | Unlock Company Profile |

| Eli Lilly | 9 | Unlock Company Profile |

| Pieris | 9 | Unlock Company Profile |

| SP Nutraceuticals | 9 | Unlock Company Profile |

| F. Hoffmann-La Roche | 8 | Unlock Company Profile |

| Fred Hutchinson Cancer Research Center | 8 | Unlock Company Profile |

| Genera Istrazivanja d.o.o. | 8 | Unlock Company Profile |

| Maruha Nichiro | 8 | Unlock Company Profile |

| UAB Research Foundation | 7 | Unlock Company Profile |

| Bristol-Myers Squibb | 7 | Unlock Company Profile |

| Sysmex | 7 | Unlock Company Profile |

| Goldfinch Bio | 7 | Unlock Company Profile |

| L&F Research | 6 | Unlock Company Profile |

| Proventiv Therapeutics | 5 | Unlock Company Profile |

| Figene | 5 | Unlock Company Profile |

| Bouygues / VAMED Engineering / Assistance Publique - Hôpitaux de Paris JV | 5 | Unlock Company Profile |

| Takeda Pharmaceutical | 5 | Unlock Company Profile |

| Mayo Clinic | 5 | Unlock Company Profile |

| Centre National de la Recherche Scientifique | 5 | Unlock Company Profile |

| Akron Children's Hospital | 4 | Unlock Company Profile |

| Regeneron Pharmaceuticals | 4 | Unlock Company Profile |

| Rhythm Pharmaceuticals | 4 | Unlock Company Profile |

| Kantum Pharma | 3 | Unlock Company Profile |

| Assistance Publique - Hopitaux de Paris | 3 | Unlock Company Profile |

| The Cleveland Clinic Foundation | 3 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Boston Medical Center (BMC) is the leading patent filers in kidney disorder treatment compositions. The Renal Department at BMC is a nationally recognized research and training program in nephrology for more than five decades. The research focuses on the immunopathogenesis of glomerular diseases, structural biology of the glomerulus, mechanisms of autoimmunity, renal cystic disease and cancer, kidney development and mechanisms of cell injury in acute renal failure.

In terms of application diversity, Boston Medical Center is the top company, followed by F. Hoffmann-La Roche and Regeneron Pharmaceuticals. By means of geographic reach, AstraZeneca holds the top position, while Idexx Laboratories and Biogen are in second and third positions, respectively.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.