Janssen’s Rybrevant (amivantamab-vmjw)/lazertinib combination and Daiichi Sankyo’s HER3-DXd (patritumab deruxtecan) each need more defined biomarkers for better patient stratification, experts said. Biomarker testing could guide more confident use in certain subgroups, but early data indicates a benefit across all-comers in epidermal growth factor receptor (EGFR)-mutated non-small cell lung cancer (NSCLC) after relapse on AstraZeneca’s Tagrisso (osimertinib).

Once a patient progresses on Tagrisso, biomarker testing is needed to identify resistance drivers and guide treatment choice, experts agreed. While data at the 2021 American Society of Clinical Oncology (ASCO) Annual meeting with Rybrevant/lazertinib provided early hints of a potential biomarker, limited patient numbers made it difficult to assign predictive qualities to the biomarkers, such as MET expression. Similarly, even though partritumab deruxtecan is directed to human epidermal growth factor receptor 3 (HER3), it is unclear if HER3 expression, which is currently not commonly tested, can be used as a biomarker to identify patients most likely to respond.

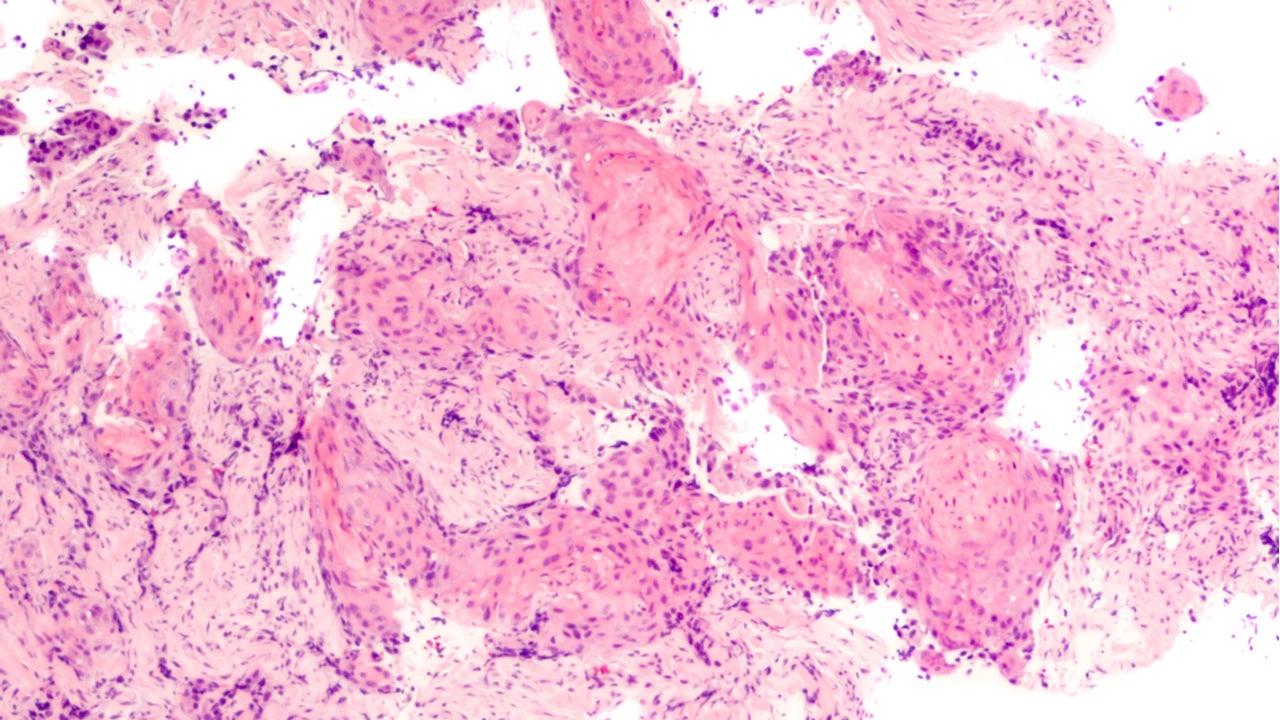

One factor making biomarker analysis challenging is the choice of test—such as next-generation sequencing (NGS), circulating tumour DNA (ctDNA) analysis, or immunohistochemistry (IHC)—where one may be more useful than another. Tumour biopsies can be difficult to obtain after progression, which may also drive the choice of a test. Early data has indicated IHC, which requires tissue samples, may be the most adept at identifying Rybrevant/lazertinib responders, but it is not ordered as often as the others.

Janssen plans to prospectively validate both NGS and IHC-based biomarkers to identify patients most likely to benefit from Rybrevant/lazertinib in a cohort in the Phase I/Ib CHRYSALIS-2 study (NCT04077463), said a spokesperson.

Tumour profiling can help guide treatments targeting subgroups with EGFR exon 20 alterations or MET amplifications, where FDA-approved treatments like Rybrevant monotherapy are more effective than the aforementioned therapies. Nonetheless, even if the resistance-driving exact mechanism of action and, consequently, a predictive biomarker is not identified, Rybrevant/lazertinib and patritumab deruxtecan can still be adopted for all eligible patients if they continue to show efficacy as in the early data, experts said. However, for the therapies to truly succeed, genomic sequencing rates will have to improve compared to current practices, experts said.

Rybrevant, which is manufactured by the Janssen Pharmaceutical Companies of Johnson & Johnson (J&J), was granted an accelerated approval last month as a monotherapy for patients with NSCLC with EGFR exon 20 insertion mutations after progression on or after chemotherapy. Rybrevant and lazertinib are estimated to make $378m and $569m in 2029, respectively, as per GlobalData consensus forecasts. J&J’s market cap is $431.96bn. Patritumab deruxtecan is expected to yield $750m in 2027. Daiichi’s market cap is JPY 4.66trn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIHC testing could identify subgroups, but is not currently part of standard of care

If therapeutic activity is defined based on biomarkers, then the best treatment can be strategized, said Dr Balazs Halmos, director, Multidisciplinary Thoracic Oncology Program, Montefiore Health Systems, New York. For example, it is better to combine a MET inhibitor with an EGFR inhibitor if the patient is known to have MET amplifications as their main resistance mechanisms, rather than just assuming the amplification exists, said Dr Timothy Yap, medical oncologist, Department of Investigational Cancer Therapeutics, University of Texas MD Anderson Cancer Center, Houston. Rybrevant is a bispecific EGFR and MET receptor-directed antibody, while lazertinib is an EGFR tyrosine kinase inhibitor (TKI).

Of the 57 patients treated with patritumab deruxtecan in the Phase I (NCT03260491), 43 were evaluable for HER3 expression and nearly all expressed the target (Abstract #9007). It is unclear whether or not HER3 can be used as a biomarker for selection or if expression levels correlate with efficacy, even though it seems logically as though it should, said Halmos. However, even if the correlation between HER3 expression and efficacy is not established, it should not be a hurdle for the therapy to be accepted, said Dr Frank Griesinger, director, Department of Internal Medicine-Oncology, Pius Hospital, Medizinischer Campus, Universität Oldenverg, Germany.

It is important to get NGS on liquid biopsies or tumour samples at the time of progression to assess variant allele frequencies and detect resistance alterations to Tagrisso, said Yap.

In the Phase I CHRYSALIS study (NCT02609776), among 45 patients treated with Rybrevant/lazertinib, 29 patients underwent NGS based on tumour samples, while ctDNA analysis was done with 44 patients (Abstract #9006). Additional analysis using EGFR/MET IHC staining was possible with only 20 patient samples, with an overall response rate (ORR) was 90% with a median duration of response (mDOR) of 9.7 months, as per the same abstract.

However, IHC testing is not typically conducted, said an expert. If a rebiopsy is required for IHC testing, then it may not be possible for everyone, said Griesinger. Strong efficacy data is needed to convince the NSCLC community to incorporate IHC testing into the standard of care, but the early data is only generating a hypothesis of greater efficacy in those MET-expressing subgroups, said Griesinger. However, if IHC is predictive, it will be used quickly, he added. IHC testing is not currently considered standard of care, but increased data and further validation of both NGS and IHC-based biomarkers will likely inform its evolution, said the Janssen spokesperson.

When rebiopsies to attain tumour tissue are not possible, liquid biopsies provide an easy alternative, experts said. However, liquid biopsies can be less sensitive in identifying amplifications compared to other tests using tumour biopsies, which provide more DNA, said Dr Timothy Burns, medical oncologist, University of Pennsylvania Medical Center Hillman Cancer Center, Pittsburgh. The tumour biopsy can be cancelled if liquid biopsies can identify a resistance mechanism, but often both are ordered to avoid missing any signals, he added.

Another pertinent factor is low testing trends, based on data at ASCO, which raises concerns on how many eligible patients are getting access to therapies, said Dr Nicola Normanno, chief, Cell Biology and Biotherapy Unit, INT-Fondazione Pascale, Naples, Italy. This is a problem is occurring worldwide, Normanno added. As per a retrospective analysis, only 10% of the overall population of 3,474 patients received a biomarker test after first-line (1L) therapy, while 79% got one or more test before frontline treatment (Abstract #9004). The ASCO presentations with both Rybrevant/lazertinib and patritumab deruxtecan were specific to treatment after 1L Tagrisso, so real-world low testing rates are particularly pertinent for their potential use, experts said. The data is a call to arms to make sure every patient who may have a targetable alteration gets access to any targeted drugs, said Dr Nathan Pennell, professor of medicine, Cleveland Clinic Lerner College of Medicine, Ohio.

Biomarker testing is more readily adopted in academic centers, said Griesinger. While routine biopsies have been performed at academic centers, their impact on driving treatment decisions has been limited because there have not been enough well-defined treatments to use based on the information, said Pennell. Clinical data with these emerging therapies may entice others to utilize them more often, said Griesinger.

Use in specific subgroups remains to be explored

The choice of biomarker is inherently linked to alterations driving the resistance mechanism. Resistance mechanisms after Tagrisso treatment are heterogeneous, said Griesinger. Additionally, resistance to EGFR TKIs is polyclonal, meaning there can be different mechanisms of resistance, said Normanno. Traditionally, biomarker testing was done to line up the next therapy, but identifying a therapy may not be as straightforward as looking for a MET amplification, said Burns.

On 29 June, this news service reported Rybrevant/lazertinib and patritumab deruxtecan showed efficacy across patients who had progressed on Tagrisso, and other patient subsets may derive a greater benefit.

It is still important to explore the specific resistance-driving mutations, said Griesinger. In CHRYSALIS, 17 of the 45 Rybrevant/lazertinib-treated patients had EGFR/MET-based resistance, as identified by NGS, with an ORR in this subgroup of 47% and a mDOR of 10.4 months, as per the same abstract. Among those who did not have any EGFR/MET-based resistance, the ORR was 29%.

With patritumab deruxtecan, which is a HER3-directed antibody drug conjugate (ADC), the target offers a chance for the payload to enter the cell even if HER3 expression is not a resistance driver, said Griesinger. The ADC seems to use HER3 as a docking site to carry the cytotoxic drug, said Normanno.

Confirmed responses were seen across a wide range of baseline tumour HER3 membrane H-scores, but there was a trend toward enrichment of confirmed responses in patients with higher baseline H-scores, said a Daiichi spokesperson. Additional analyses in patritumab deruxtecan studies are needed to better understand the role of HER3 expression in optimal patient selection, the spokesperson added.

Manasi Vaidya is a Associate Editor for Clinical Trials Arena parent company GlobalData’s investigative journalism team. A version of this article originally appeared on the Insights module of GlobalData’s Pharmaceutical Intelligence Center. To access more articles like this, visit GlobalData.