Backing investments that support the achievement of the UN’s Sustainable Development Goals (SDGs), amid embracing environmental, social and governance (ESG) factors, has become significant for investors that are looking to generate impact without compromising on returns.

Indeed, there has been an increasing interest in embracing ESG following the outbreak of the Covid-19 pandemic, as investors have seen it as a way to waterproof their investments from future disruptive events.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Investment Monitor has identified six key areas for investors to watch for opportunities in 2022.

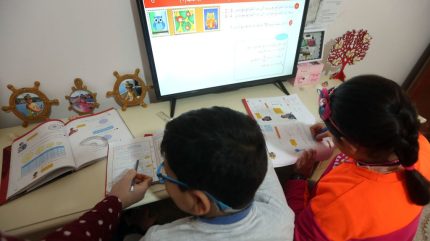

Educational technology

Investment in education, and more specifically in educational technology (edtech), has seen its profile rocket because of widespread school closures across the world following the outbreak of the Covid-19 pandemic.

Indeed, edtech is going to be more important than ever in the post-pandemic world, because of how it provides children and adults with access to high-quality education, and enables them to gain the skills that will improve their employment prospects. For many in the developed world, the physical distance between their habitation and a place of education restricts their learning opportunities. If they have a phone, tablet or computer, along with a Wi-Fi signal, many of these challenges are done away with.

Edtech is seen as a sector that will attract a lot of interest from investors in the coming years, particularly from venture capitalists that are targeting heavily populated countries.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInvestments in edtech are significant for achieving SDG4, which focuses on ensuring inclusive and equitable education and promoting lifelong learning opportunities for all.

Telehealth and virtual health

The Covid-19 pandemic has brought investment in health-related sectors into sharp focus, given the shortfalls exposed and the strains that healthcare services have come under due to the virus’s rapid spread.

Investing in sectors related to the telehealth and virtual healthcare industry is much needed, as the reach and cost efficiencies associated with these technologies are enormous and help the disadvantaged with their healthcare needs in ways that were not possible when all patients had to rely upon physical appointments.

The pandemic has seen rapid progress made in the telehealth and virtual healthcare industry. Investments in these fields can generate an enormous impact, and can assist many countries in getting back on track in terms of meeting the SDG3 targets, which are based around achieving good health and well-being.

Social infrastructure

By backing infrastructure projects based around education, affordable housing and healthcare, investors can diversify their portfolio and deliver social impact.

There is a real opportunity for private capital to be injected into social infrastructure, especially in healthcare buildings or care homes across the world, given the funding shortfalls that many governments are facing due to resources being diverted as a result of the Covid-19 pandemic. This is essential for achieving SDG3.

What is more, investments in education infrastructure can assist in meeting the targets of SDG4. Social infrastructure also includes investment in affordable housing, which is significant for eradicating poverty (SDG1) and hunger (SDG2), and reducing inequalities (SDG10).

Clean water and sanitation

With handwashing being a key recommendation for stopping the spread of Covid-19, investors looking to make a social impact will find opportunities in clean water and sanitation projects, particularly in countries where there is limited water and sewage infrastructure.

Some examples of investment opportunities in this sector include asset building and infrastructure creation, such as clean water provision, safe toilets and waste management, handwash stations, fecal sludge management and treatment plants.

Investing in clean water and sanitation is essential for preventive healthcare, reducing instances of future pandemics, and achieving SDG6, which involves ensuring the availability and sustainable management of water and sanitation for all.

Climate action

Taking urgent action to combat climate change is now a pressing priority for many investors looking to expand or relocate their business in the post-pandemic world. These investors should target opportunities in green projects that promote sustainable development and in projects that reduce carbon emissions.

Such investments could be in biodiesel production plants, and biofuel and ethanol production, in energy storage and energy transmission infrastructure, hybrid mini-grids, dry sanitation technologies, and in recycling systems and plans for the reuse of solid waste.

Backing such investments promotes sustainable development and the achievement of SDG13, which targets combatting climate change and its impact upon the world.

Biodiversity

Biodiversity loss is one of the biggest environmental challenges facing the world. This is why investors should see it as an opportunity to back projects that could have a positive impact on battling biodiversity loss and achieve SDG15.

More specifically, SDG15 focuses on protecting, restoring and promoting the sustainable use of terrestrial ecosystems, sustainably managing forests, combatting desertification, and halting and reversing land degradation.

Some investments that could promote the achievement of SDG15 include those in mixed plantation forestry for sustainable commercial timber production, production of compost and biofertilisers from food waste, affordable irrigation systems, agricultural logistics services, food processing and collection services, and green biotechnology.

Investing in sectors that promote the achievement of the 2030 targets of the SDGs is essential for sustainable development. However, investors should not only focus on the sectors that they invest in, but also on the way that they invest. Embracing diversity and inclusion within the workforce, as well as supporting gender equality, should be at the forefront of investment strategies as a way to promote sustainable development, deliver societal impact, reduce the role of the informal economy, boost job creation and generate higher profits.