Biopharmaceutical company Trevena has resubmitted a new drug application (NDA) to the US Food and Drug Administration (FDA) for IV oliceridine.

Oliceridine is the company’s investigational product intended for the management of moderate-to-severe acute pain.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Oliceridine injection is an intravenous (IV) analgesic designed to improve conventional opioid pharmacology to provide the pain-reducing potential of an opioid with minimum associated adverse effects.

The company expects a six-month review period of the NDA.

The resubmission was based on the outcome of a Type A meeting with the FDA, which was conducted to obtain clarity on Complete Response Letter (CRL) with respect to oliceridine.

The resubmission package comprised data from the multi-dose healthy volunteer QT trial, nonclinical data that confirmed inactive metabolite levels, and reports regarding validation of the drug product.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTrevena said that the resubmission package also specified a maximum daily dose of 27mg, as earlier acknowledged by FDA in the Type A minutes of meeting (MOM).

No efficacy data or any comparative data versus IV morphine were requested as part of the CRL, stated Trevena.

Trevena president and CEO Carrie Bourdow said: “The resubmission of the oliceridine NDA represents a significant milestone for the programme and an important achievement for the company. I am thankful for the team’s commitment and diligent work to bring us to this exciting point.

“We appreciate FDA’s guidance through the resubmission process and look forward to continuing to work closely with the agency as they review our application.”

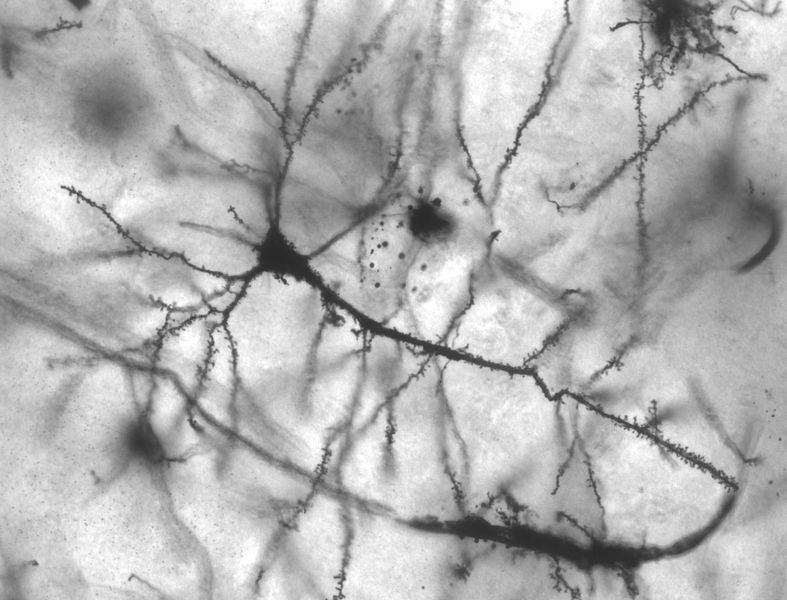

Based in the US, Trevena is involved in the development and commercialisation of novel medicines for patients with central nervous system (CNS) disorders.

It has four novel and differentiated investigational drug candidates under its portfolio.