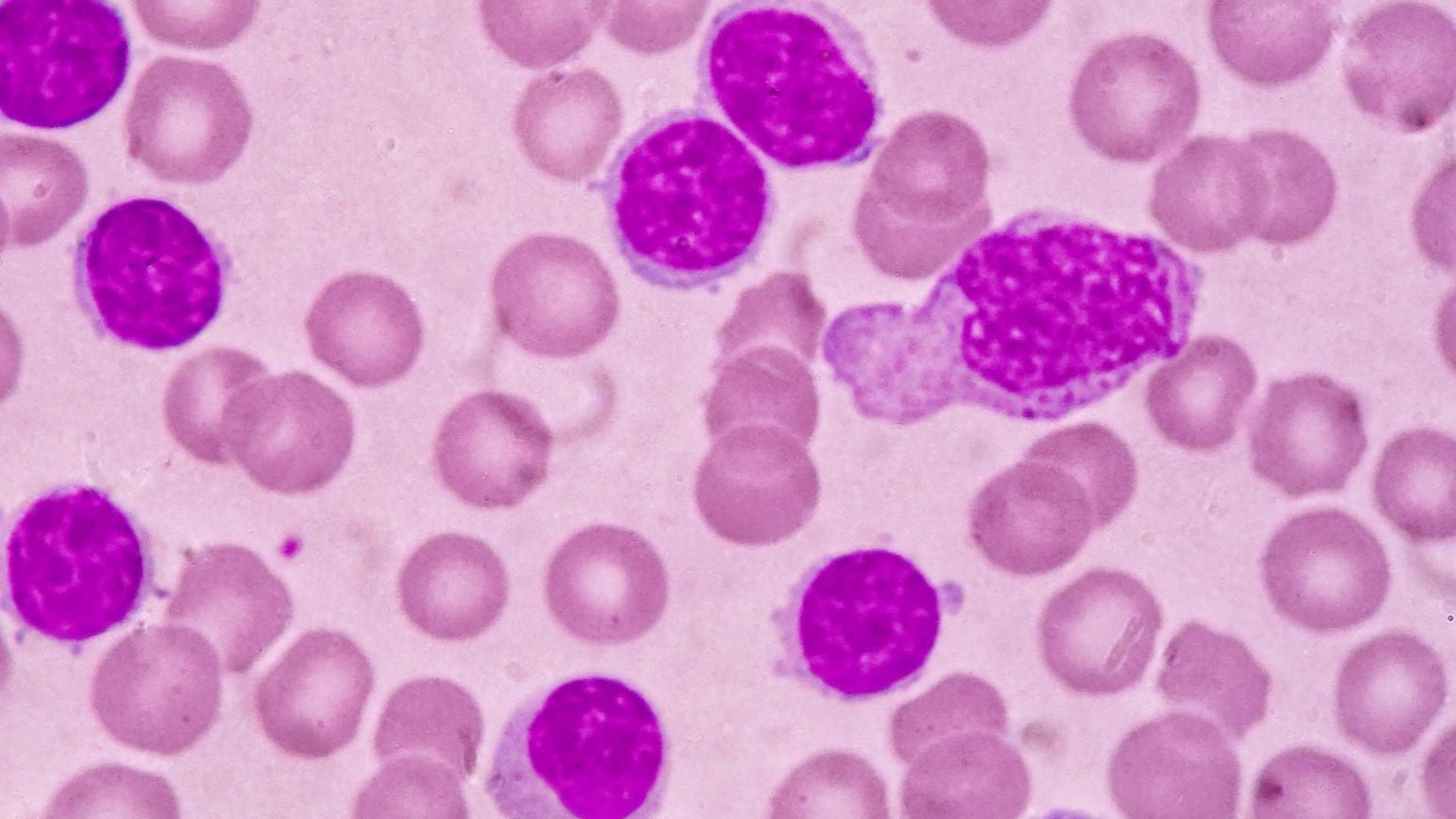

China-based biotech BeiGene Therapeutics recently announced FDA approval of its small molecule Bruton tyrosine kinase inhibitor (BTKi), Brukinsa (zanubrutinib), for patients with chronic lymphocytic leukaemia (CLL) or small lymphocytic lymphoma (SLL). This is the fourth indication for which Brukinsa has received regulatory approval, with the small molecule inhibitor already marketed for Waldenström macroglobulinemia, mantle cell lymphoma, and marginal zone lymphoma. CLL is an indolent B-cell malignancy and is the most common adult leukaemia in the US, with approximately 20,000 new cases expected to be diagnosed in 2023. Many CLL patients are asymptomatic and don’t require treatment while others require therapy indefinitely until disease progression or toxicity. BTKis have become the standard of care for symptomatic CLL/SLL patients with high-risk disease, since the approval of AbbVie and Johnson & Johnson’s Imbruvica (ibrutinib) almost a decade ago.

Approval of Brukinsa was granted based on impressive results reported from two Phase lll trials. Efficacy for treatment-naïve patients was evaluated in the SEQUOIA study, in which a cohort of 479 patients randomly received either Brukinsa or the chemoimmunotherapy regimen of bendamustine + rituximab (BR). Median progression-free survival (PFS) was not reached in the Brukinsa arm while it was 33.7 months in the BR arm (hazard ratio [HR]: .42). In a separate cohort of previously untreated patients bearing a 17p deletion, a major risk prognosticator in CLL, the overall response rate (ORR) was 88%, with the median duration of response (DoR) not reached. Superiority over Imbruvica was demonstrated in the ALPINE study, in which 652 patients with relapsed or refractory CLL/SLL were randomised 1:1 to receive Brukinsa or Ibruvica. In the head-to-head study, PFS in the Brukinsa arm was superior to the Imbruvica arm (hazard ratio [HR]: .65). In addition to improving efficacy, the more selective BTK inhibition achieved with Brukinsa led to a significantly lower incidence of cardiovascular adverse events, with 3.7% of patients treated with Brukinsa experiencing atrial fibrillation versus 12% with Imbruvica.

Imbruvica’s net revenue sales for the third quarter of 2022 were $1.14bn, a 17% decrease from the previous year. These figures are expected to decrease further as Brukinsa, which had $155.5m in sales in the same quarter, will now take a sizeable share of Imbruvica’s sales. Additionally, BeiGene is evaluating Brukinsa as a first-line therapy in combination with BGB-11417, the company’s BCL-2 inhibitor, which could further increase Brukinsa’s sales. The combination of Brukinsa with a BCL-2 inhibitor in the first-line setting is also being investigated in the SEQUIOA study with Abbvie’s Venclexta (veneotclax), with an ORR of 96.8% reported for high-risk Del 17p patients.

AstraZeneca’s second-generation BTKi Calquence (acalabrutinib) has a first-to-market advantage and will challenge Brukinsa’s market adoption. Further competition will likely come from third-generation BTKis in late-stage development, such as Eli Lilly’s LOXO-305 (pirtobrutinib). These third-generation, noncovalent BTKis in the pipeline have a theoretical advantage over the currently marketed BTKis (Imbruvica, Calquence, Brukinsa) because of their reversible binding that allows for higher BTK inhibition while also reducing off-target toxicity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData