Attention deficit hyperactivity disorder (ADHD) is a clinically heterogeneous disorder, with published research often putting comorbidity estimates at between 60%–80%. Comorbidities commonly associated with ADHD include anxiety disorder, tic disorder, and depression, all three of which key opinion leaders (KOLs) interviewed by GlobalData noted can influence treatment choices. A GlobalData high-prescriber survey completed by prescribers within the seven major markets (7MM; the US, France, Germany, Italy, Spain, the UK, and Japan) confirmed significant rates of comorbidity with anxiety disorder, tic disorder, and depression, among other comorbidities. Therefore, the potential to address these comorbidities could lead to an opportunity for pipeline products to capture a larger share of the ADHD market.

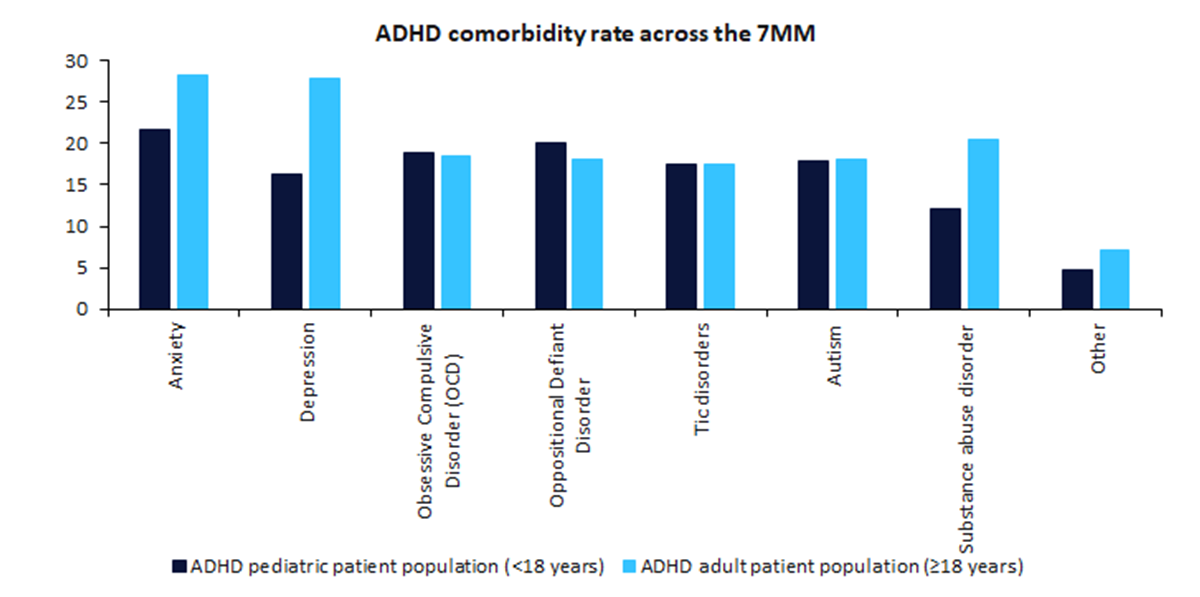

ADHD is a neurodevelopmental disorder characterised by age-inappropriate, extreme, and impairing levels of inattention and/or hyperactivity and impulsivity. Comorbid psychiatric disorders and learning difficulties are common with both adult and paediatric patients with ADHD but have been reported to be highest in the adult patient population, with sources stating the rate to be as high as 80% of the adult ADHD patient population. In January 2024, GlobalData surveyed 125 high-prescribing physicians from the 7MM on the most frequent comorbidities seen in their patients. The survey revealed anxiety disorder as the most common comorbidity with ADHD in the 7MM in both adult and pediatric patients, at 28.3% and 21.7%, respectively (Figure 1). Depression and tic disorder, both noteworthy for having been referenced by KOLs as having an impact on treatment choices, were the third and fifth most frequent comorbidities respectively, with depression being the second highest comorbidity in the adult ADHD population.

There are currently four ADHD pipeline agents within late-stage development in the 7MM: Otsuka’s centanafadine SR, Axsome Therapeutics’s solriamfetol, Neurocentria’s NRCT-101SR (L-Threonate magnesium salt), and Cingulate’s CTx-1301 (dexmethylphenidate). Among these, some show early potential of also addressing comorbid anxiety disorder and depression. In a Phase I trial, NRCT-101SR showed an improvement in mood status including a reduction in anxiety and depression symptoms in patients with ADHD. Both solriamfetol and centanafadine SR are also pipeline agents for major depressive disorder, with a planned Phase III trial for solriamfetol and an ongoing Phase II trial for centanafadine SR. However, there remains opportunity to investigate the efficacy of these products with ADHD and comorbid depression. At the time of writing, CTx-1301 is under investigation for the treatment of ADHD with no reporting found on its effects on ADHD comorbidity. Products that target both the ADHD and comorbid symptoms are likely to have a positive effect on prescriber perceptions around the agent and market share, as seen in the case of Takeda’s Intuniv (guanfacine).

While stimulant medications such as methylphenidate are first-line pharmacotherapies in the treatment of ADHD in the 7MM, KOLs expressed a hesitancy to prescribe stimulants and a preference towards Intuniv in patients with ADHD and comorbid anxiety or tic disorder. They also expressed a preference for Intuniv over other non-stimulant agents due to competitive efficacy and its contribution to mood regulation. That said, KOLs also note that Intuniv has weaknesses in that it can take three weeks to see its effects on core ADHD symptoms and that its efficacy in comparison to stimulants is modest. In addition, currently Intuniv is not approved for use within the adult population and thus is used off-label in adults across 6MM, while it is also not currently available in Italy. Therefore, there is still potential for NRCT-101SR, solriamfetol, and centanafadine SR to capitalize on addressing ADHD comorbidity, particularly within the adult population, to gain market share. However, further clinical trials in these specific patient populations must be conducted.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData