The perpetual problem of under-recruitment within clinical trials was inevitably discussed between key industry players throughout the 10th annual Outsourcing in Clinical Trials (OCT) DACH Conference between 21 and 22 November 2023 and the 10th annual Clinical Trials in Oncology (CTO) Europe Conference from 28 to 29 November 2023. Classic statistics regarding the underperformance of clinical trial sites, such as the fact that 66% of sites fail to meet enrolment targets, and 50% of sites enrol zero to 1 patient, were re-iterated, and accompanied by several thoughtful presentations highlighting ways to compare sites’ key performance indicators to optimise site selection and improve site engagement.

At the OCT DACH conference, Sverre Bengtsson, co-founder of Viedoc, provided startling insight into the fact that 70% of clinical trials are conducted at the same 5% of eligible sites. This begs the question: why aren’t the other 95% of eligible sites being utilised in clinical trials? It appears that sites’ historical underperformance throughout clinical trials has increased sponsors’ reluctance to engage with those that have traditionally underachieved, which drastically reduces the pool of sites with which sponsors appear willing to engage.

Sponsors look closely at budgets

Sponsors’ trepidations are further fuelled by additional challenges in recruitment caused by the ever-increasing trial complexities, which has resulted in 283% growth in data points for Phase III trials from 2010–23, as reported during OCT DACH by Andy Gurd, senior director of product marketing at Medidata. Additionally, rising trial costs due to inflation have made sponsors take a closer look at budgets and streamline their site selection.

However, a thought-provoking presentation delivered at CTO Europe by Stefanie Schier-Mumzhiu, director and global programme operational head at MorphoSys, demonstrated how relaxing the criteria imposed on sites during selection, and doubling the number of sites selected for a trial, can drastically increase recruitment. Schier-Mumzhiu explained that their strategy at MorphoSys involves limiting the time spent negotiating with sites and ultimately being more accommodating to their terms and conditions. She provided case studies that proved that this strategy had ensured all trials met or exceeded their enrolment targets, which had enabled a drug to reach market one month earlier. Schier-Mumzhiu explained that the profit this will accrue drastically outweighs the additional investment required to double sites.

Waiting for reform of how sites recruit

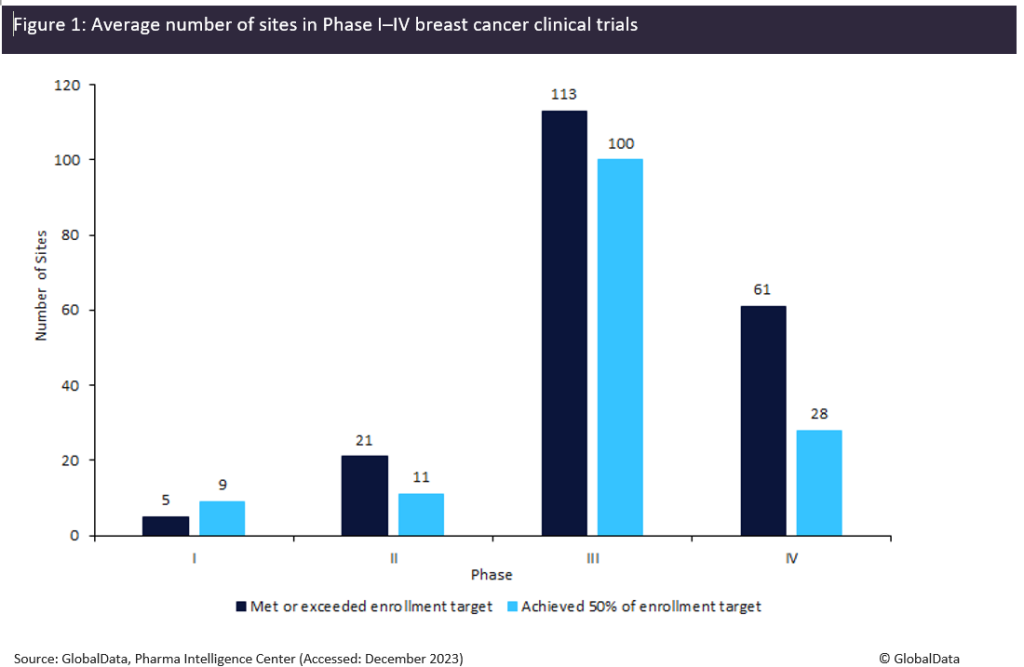

Insights from GlobalData’s Trials Intelligence platform comparing the difference between the number of sites in breast cancer trials from Phase I–IV corroborated this, as it was demonstrated that Phase II to Phase IV trials that had hit or exceeded their enrolment targets had more sites than trials that had only achieved 50% of their targeted enrolment (Figure 1). The only exception was Phase I trials, which had the smallest cohort so was significantly less affected by recruitment challenges.

As shown in Figure 1, Phase II breast cancer trials that hit their enrolment targets have 45% more sites than those that only achieved 50% of their target; the margins are smaller in Phase III trials with 13% more trial sites for those that successfully met or exceeded targets. The most drastic difference is Phase IV as trials that hit their enrolment targets have 53% more trial sites than those that managed to achieve 50%. However, some argue that this approach fails to address the underlying issue affecting site performance and will only pay off if a company manages to bring its drug to market, which is an enormous feat on its own. Regardless, it is evident that this strategy is being utilised successfully throughout the industry, and it has proven to be a tangible solution to address low accrual as we await a complete reform regarding how sites recruit within clinical studies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData