On 24 August, Exelixis announced the early suspension of the double-blinded Phase III CABINET pivotal trial evaluating Exelixis’s Cabometyx (cabozantinib) for patients with progressive, well-differentiated advanced pancreatic neuroendocrine tumours (pNETs) and extra-pancreatic neuroendocrine tumours (extra-pNETs) after at least one line of prior therapy based on dramatic positive interim results analysis. The company’s leading flagship molecule yielded a significant improvement in efficacy with substantially longer progression-free survival (PFS) across the trial’s cohorts versus placebo and awaits debriefing for FDA review. Patients with progressive pNETs and extra-pNETs face challenges of few effective treatment modalities and lack of a standard of care regimen. Therefore, expanding the therapeutic arsenal for these patient populations remains a significant unmet need that may be addressed by Cabometyx.

Cabometyx is a multitargeted tyrosine kinase inhibitor (MTKI) directed to the vascular endothelial growth factor (VEGF) receptor, hepatocyte growth factor receptor (MET), and Axl receptor tyrosine kinase (AXL) implicated in progressive disease for pNETS and extra-pNETs. Cabometyx is approved for the treatment of advanced renal cell carcinoma, medullary thyroid cancer, and hepatocellular carcinoma.

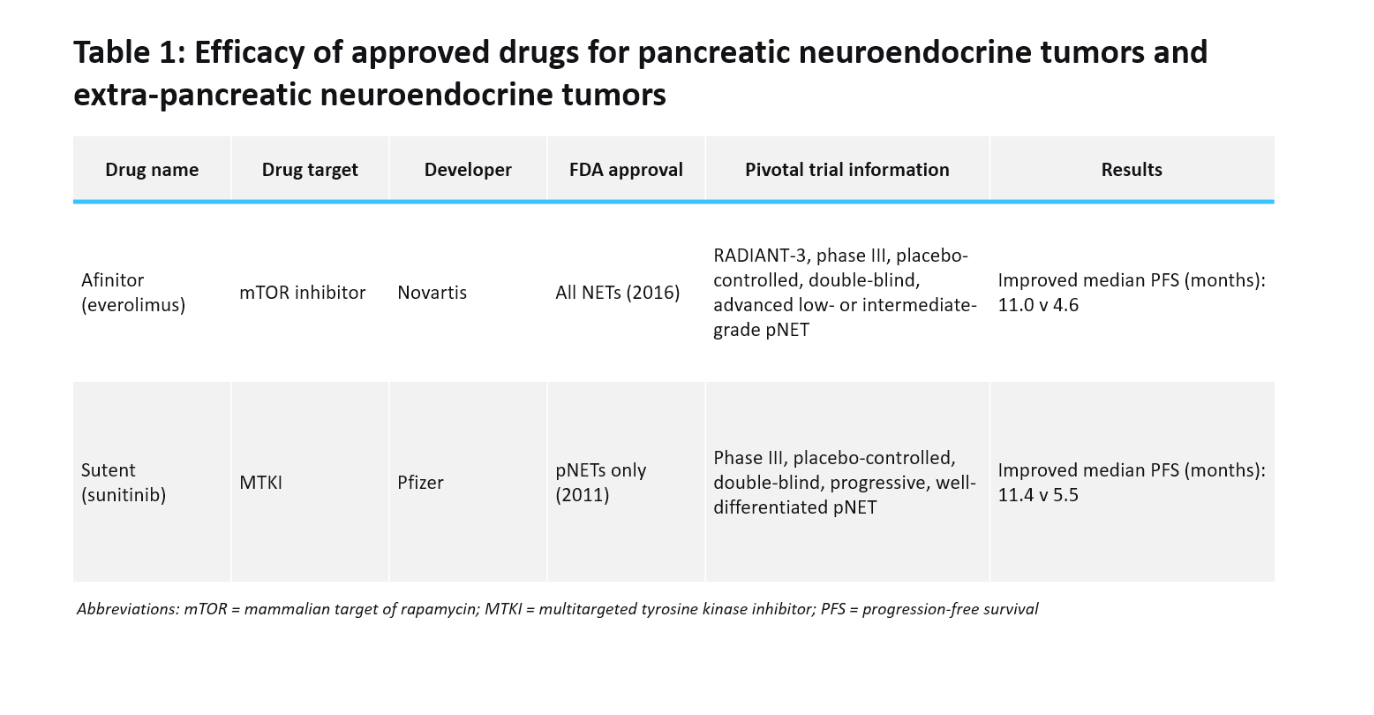

Current treatment options for advanced pNETs and extra-pNETs include somatostatin analogues (SSAs), targeted molecular therapy, peptide-receptor radionuclide therapy, and chemotherapy with no standard treatment sequence. In patients with progressive disease, only two agents have been shown to improve PFS: Novartis’s Afinitor (everolimus) and Pfizer’s Sutent (sunitinib) (Table 1). Sutent is the only approved MTKI for pNETs, setting the benchmark for Cabometyx’s promising preliminary PFS results. However, interpreting Cabometyx’s efficacy results will be challenging due to the placebo-controlled design without a direct comparison to available treatments.

According to the analysis consensus forecast, GlobalData anticipates Cabometyx’s projected total annual sales to reach $3.3bn by 2029, driven by its strong performance in its approved indications and label-expanding studies. Although Cabometyx has suffered two Phase III failures in lung carcinoma and renal cell carcinoma, Cabometyx in combination with Roche’s immune checkpoint inhibitor Tecentriq (atezolizumab) had recent success in the Phase III CONTACT-02 study with significant PFS for metastatic castration-resistant prostate cancer patients. Additionally, the completed Phase III COSMIC-313 study revealed that patients with untreated, advanced renal cell carcinoma derived clinical benefit with a longer PFS from Cabometyx in combination with Bristol Myers Squibb’s Opdivo (nivolumab) and Yervoy (ipilimumab). Competition for Cabometyx remains limited as other new or emerging MTKIs are awaiting clinical trial validation. Sutent will remain the dominant MTKI in the pNET and extra-pNET market as positive FDA reception for Cabometyx is eagerly anticipated.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData