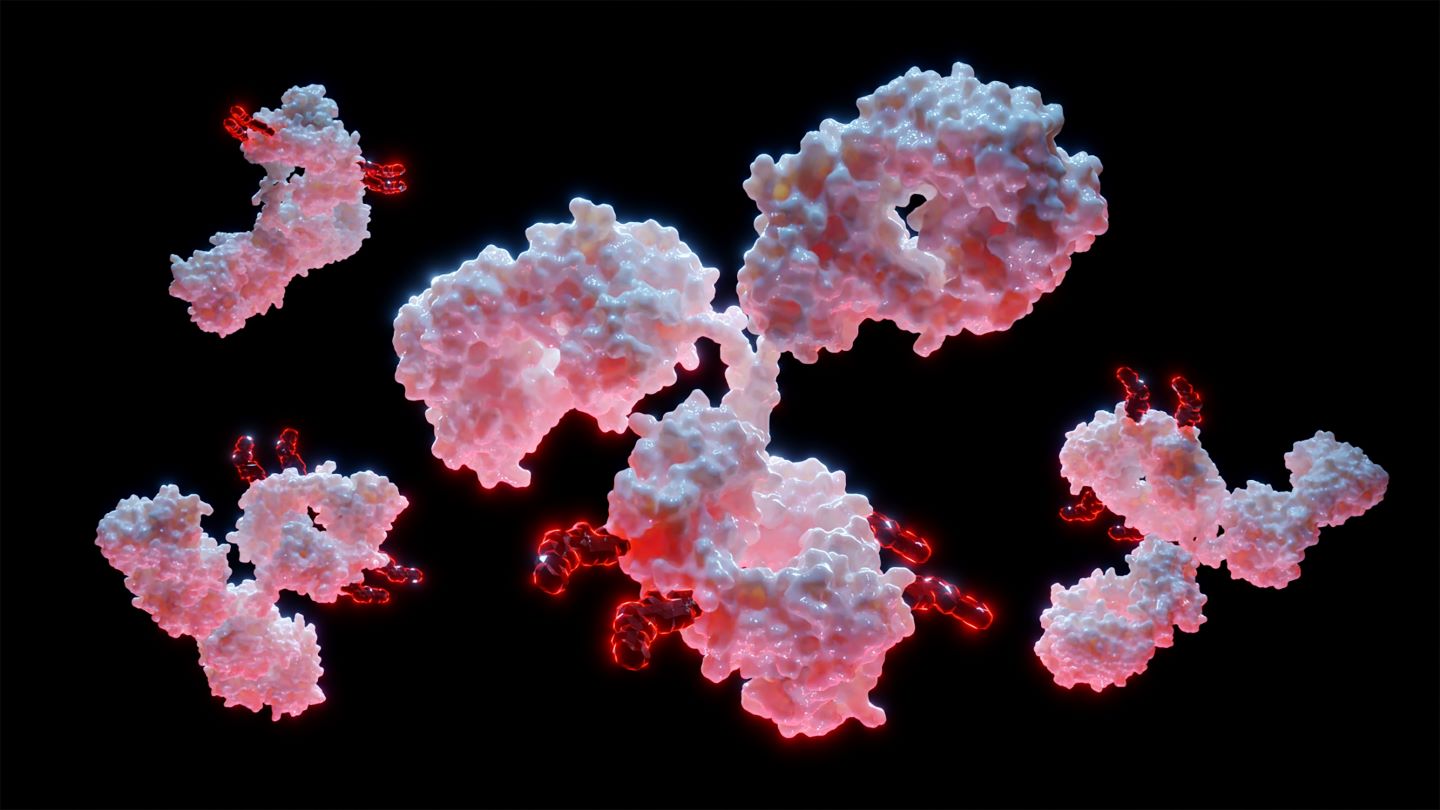

At the European Society of Medical Oncology (ESMO) Congress on 20–24 October 2023, where more than 3,000 posters and oral presentations were showcased, much of the focus was on new data for antibody-drug conjugates (ADCs) and bispecific T-cell engagers (BiTEs), which are paving the future of oncological clinical development.

Some ADCs showed promising results, including AstraZeneca and Daiichi Sankyo’s Dato-DXd (datopotamab deruxtecan) plus AstraZeneca’s Imfinzi (durvalumab) as a treatment for metastatic triple-negative breast cancer patients, as well as Seagen and Genmab’s Tivdak (tisotumab vedotin) for cervical cancer patients whose illness progressed after undergoing front-line therapy.

Both Amgen’s tarlatamab (AMG-757) for patients with small cell lung cancer (SCLC) who have failed at least two prior lines of treatment and Kimmtrak (tebentafusp-tebn) for metastatic uveal melanoma (mUM) captured high interest as they are breaking new ground in the BiTE space.

Seagen and Genmab’s Tivdak boosts survival rates in cervical cancer patients

Tivdak is an ADC comprising a fully human monoclonal antibody targeting tissue factor, which is chemically bonded to the microtubule-disrupting compound monomethyl auristatin E. The culmination of the randomised, open-label Phase III innovaTV 301/ENGOT clinical trial involving recurrent or metastatic cervical cancer patients with disease progression on or after first-line therapy was presented at ESMO and brings new insights to augment the existing knowledge base established by the earlier innovaTV 204 study.

The results obtained from innovaTV 204 were instrumental in securing accelerated approval for Tivdak in the US in 2021. As ongoing discussions with regulatory authorities progress, the forthcoming data from innovaTV 301 is poised to serve as the pivotal confirmatory investigation to help Tivdak gain full approval from the FDA and to substantiate its applications for global regulatory clearance.

Tivdak demonstrated a modest enhancement in overall survival. After a median follow-up duration of 10.8 months (95% confidence interval [CI], 10.3–11.6), the median overall survival (OS) for tisotumab vedotin reached 11.5 months (95% CI, 9.8–14.9), compared to 9.5 months (95% CI, 7.9–10.7) for patients treated with chemotherapy (hazard ratio [HR], 0.70, 95% CI, 0.54–0.89; P = 0.0038). Furthermore, the median progression-free survival (PFS) stood at 4.2 months (95% CI, 4.0–4.4) for those treated with tisotumab vedotin, compared to 2.9 months (95% CI, 2.6–3.1) for those who received chemotherapy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNotably, the six-month PFS rates for tisotumab vedotin and chemotherapy were 30.4% and 18.9%, respectively. Such results signify the possibility of Tivdak bringing about a transformation in the standard of care of clinical approaches and offering renewed hope to cervical cancer patients seeking an alternative treatment. Tivdak currently has a strong market position as the second-line cervical cancer treatment market is relatively sparse. According to GlobalData’s patient-based forecast, Tivdak is forecast to generate sales of $1.4bn in the eight major pharmaceutical markets (8MM) (US, France, Germany, Italy, Spain, UK, Japan, and Canada) by 2030. However, the same does not hold true for the first-line setting, where Tivdak aims to gain approval in the future.

Competing with Merck & Co (MSD)’s blockbuster treatment Keytruda (pembrolizumab) in the first-line space, Tivdak will be hindered by the requirement for patients to undergo an ophthalmic examination before each dose, which might pose challenges for certain patients, particularly considering the fact that ophthalmologists are typically located outside of hospital facilities, potentially impacting Tivdak’s adoption.

Dato-Dxd plus Imfinzi demonstrates robust results for metastatic triple-negative breast cancer

Around 15% of breast cancer patients receive a diagnosis of triple-negative breast cancer (TNBC) each year globally, making it the most aggressive subtype among breast cancers with limited effective treatment options. The combination of Dato-DXd, a trophoblast cell surface antigen 2 (TROP2)-targeting ADC, and Imfinzi, a programmed cell death protein 1 (PD-L1) inhibitor, is intended as a first-line treatment for patients with metastatic TNBC and is aimed to address this unmet need.

The findings from the BEGONIA Phase Ib/II trial presented at ESMO revealed that Dato-DXd combined with Imfinzi exhibited a confirmed objective response rate (ORR) of 79% (with 49 out of 62 patients responding), comprising six complete responses and 43 partial responses (PRs). Remarkably, positive responses were observed irrespective of the level of PD-L1 expression. The median PFS reached 13.8 months (with a 95% CI between 11 and not calculable [NC]), while the median duration of response (DoR) was 15.5 months (95% CI: 9.9–NC), based on 11.7 months of follow-up data.

Notwithstanding these advancements, one significant hurdle that lies ahead is the discovery of a biomarker that can aid in the selection of the most suitable candidates for datopotamab deruxtecan treatment. Notably, patients in the BEGONIA study were not selected for TROP2 expression. The successful identification of such a biomarker would also allow for potential clinical trials in other cancer types, facilitating a wider market presence and strengthening Dato-DXd’s competitive advantage as it would be able to demonstrate broader utility. According to GlobalData’s consensus analyst forecast, global sales for Dato-Dxd are expected to reach $2.5bn by 2029, which is driven by expansion into various other advanced solid tumours, including ovarian cancer, non-small cell lung cancer, and bladder cancer.

First-in-class DLL3-targeting BiTE could be the next big player in small-cell lung cancer

Historically, SCLC has presented a formidable challenge due to the absence of viable treatment options, particularly in the third-line treatment setting, where no specific therapies have been officially approved. Tarlatamab, showing promise for a third-line treatment, operates through the dual binding of the delta-like ligand 3 (DLL3) antigen present on tumour cells and the cluster of differentiation 3 (CD3) antigen found on T-cells.

This dual interaction triggers the activation and redirection of T-cells, causing them to target and eliminate tumour cells that express DLL3, which is expressed in over 80% of SCLC patients. The Phase II DeLLphi-301 trial focused on SCLC patients who had undergone a median of two prior treatment regimens. It aimed to evaluate two effective doses, 10mg and 100mg, aligning with the objectives of the FDA’s Project Optimus initiative, which aims to modernise the approach to dose optimization and selection in the field of oncology drug development. The administration of a 10mg dose of tarlatamab resulted in a noteworthy 40% ORR (97.5% CI 29–52). In contrast, patients who were administered a higher dose of 100mg exhibited a reduced ORR of 32% (97.5% CI 21–44). Notably, the lower 10mg dose displayed superior outcomes in terms of median PFS, achieving a significant 4.9 months (95% CI 2.9–6.7), compared to 3.9 months (95% CI 2.6–4.4) in the 100mg dose group. However, one notable area of concern is its safety profile, as one patient in the 10mg group succumbed to respiratory failure, an outcome that the investigators attributed to a potential association with tarlatamab.

These findings are highly promising for this particular group of patients. Since Amgen has already classified the trial as pivotal, it is probable that it will proceed with a regulatory submission in the near future. According to GlobalData’s consensus forecast, tarlatamab is anticipated to achieve peak sales of $788m by 2029. If tarlatamab is approved, that would be the first validated instance of targeting DLL3/CD3 in the clinic.

Kimmtrak displays sustained benefit in previously untreated metastatic uveal melanoma

Kimmtrak is the first BiTE therapy approved for the treatment of mUM, an aggressive cancer of the eye that has long been associated with dismal overall survival (OS) and the absence of efficacious therapeutic interventions. Nonetheless, a notable turning point transpired in 2022 when regulatory authorities granted approval for Kimmtrak as a therapeutic option for individuals diagnosed with HLA-A*02:01-positive mUM.

At ESMO, three-year survival data from the pivotal Phase III trial, IMCgp100-202, unveiled a three-year OS rate of 27% in the Kimmtrak group, compared to 18% in patients who received the therapy chosen by the investigator. Regarding Kimmtrak’s real-world effectiveness in treating mUM, 53% of patients managed to extend the interval between their outpatient visits from every week to once every three weeks following a median of six doses. Furthermore, premedications were discontinued for 53% of patients after a median of seven doses. Considering Kimmtrak’s pioneering position and well-defined trial results, it is improbable that competitors will substantially diminish Kimmtrak’s market presence unless they can demonstrate clear superiority in a direct comparative study.

According to GlobalData’s consensus forecast, Kimmtrak is anticipated to reach global sales of $542m by 2029.