Insomnia is the most common sleep disorder, characterised by patient-reported difficulty with sleep initiation and/or sleep maintenance. According to the American Psychiatric Association, a third of adults have reported insomnia symptoms, which can include frequent awakenings, difficulty returning to sleep after awakenings and awakening too early with the inability to return to sleep.

Cognitive behavioural therapy for insomnia (CBT-i) is considered the first-line therapy for chronic insomnia that lasts for at least three months. Patients are encouraged to adopt a good sleeping routine and develop the skills to improve sleep and prevent insomnia relapse. When CBT-i is either unavailable or ineffective, pharmacotherapy is recommended for short-term use. Z-drugs such as zolpidem, zopiclone and eszopiclone are the most common first-line treatment for insomnia across the seven major markets (7MM: the US, France, Germany, Italy, Spain, the UK and Japan).

However, as Z-drugs promote GABA neurotransmission, cognitive impairment, dependence, withdrawal symptoms and falls due to problems with balance are common risks associated with long-term use of these drugs. The approval of dual orexin receptor antagonists (DORAs) for the treatment of insomnia, which selectively inhibit arousal and promote sleep, offer a superior safety profile when compared to Z-drugs. However, key opinion leaders (KOLs) interviewed by GlobalData noted that the marketed DORAs fall short in comparison to Z-drugs in terms of efficacy. Thus there is an unmet need for additional effective treatment options for insomnia.

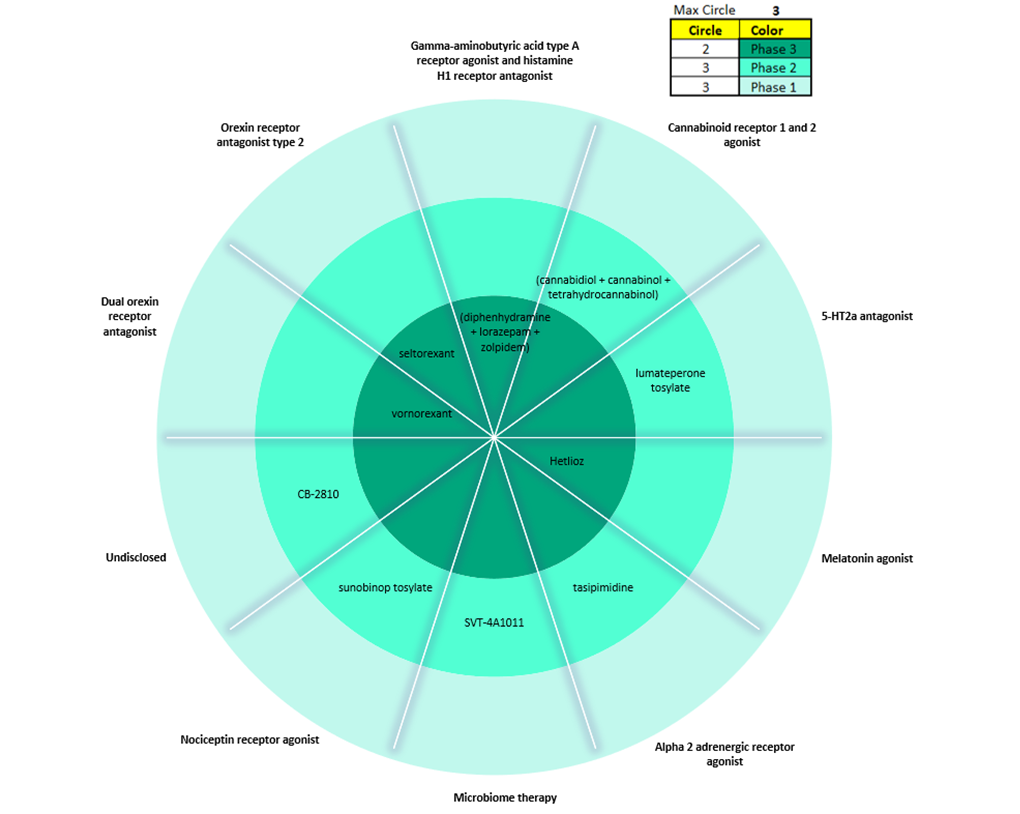

Figure 1 summarises products within the insomnia pipeline in the 7MM across all three stages of clinical development and their mechanisms of action (MOAs). There is a limited number of late-stage pipeline agents for insomnia, with only four products in Phase III development: Vanda Pharmaceuticals’s Hetlioz (tasimelteon), EUSOL Biotech’s SM-1 (diphenhydramine + lorazepam + zolpidem), Taisho Pharmaceutical’s vornorexant, and Johnson & Johnson’s seltorexant.

Overview of the insomnia pipeline in the 7MM:

Source: GlobalData, Pharma Intelligence Centre (Accessed August 2023)

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNote: each circle represents the phase of development. The inner circle signifies drugs in Phase III. The middle circle signifies Phase II. The outer circle signifies Phase I. 7MM: US, France, Germany, Italy, Spain, UK, and Japan.

Hetlioz is a melatonin agonist that is already FDA-approved for two rare sleep disorders: non-24-hour sleep-wake disorder and Smith-Magenis syndrome. But Vanda Pharmaceuticals is looking to pursue label expansion, with plans to file a supplemental new drug application (sNDA) for the treatment of insomnia in 2024. This would set up the drug to compete with marketed melatonin receptor agonists including Takeda’s Rozerem (ramelteon) and generic versions of ramelteon. SM-1 combines an antihistamine (diphenhydramine), benzodiazepine (lorazepam), and a Z-drug (zolpidem) in a single pill for the treatment of acute insomnia. However, inexpensive generic versions of each of these drugs are already marketed separately for insomnia, which could limit the uptake of the combined formulation. Taisho’s vornorexant could be the next DORA to enter the market and compete with Merck’s Belsomra (suvorexant), Eisai’s Dayvigo (lemborexant) and Idorsia’s Quviviq (daridorexant). Unlike DORAs, which target both orexin receptor type 1 and type 2, J&J’s seltorexant selectively antagonises orexin receptor type 2 and is being investigated as an adjunctive therapy to antidepressants for patients with major depressive disorder and insomnia symptoms.

The insomnia market is heavily genericised, creating a difficult competitive environment for new products. KOLs highlighted the need for companies developing drugs for insomnia to conduct head-to-head trials in addition to placebo-controlled clinical trials to help differentiate the products. With the growing number of orexin receptor antagonists anticipated to enter the market, KOLs noted that although it was understood how the marketed DORAs differed in their bioavailability, it remains unclear how the individual half-lives of each DORA correlate with symptom improvement in either difficulty with sleep initiation or sleep maintenance. KOLs believed that clinical trial designs that include the stratification of patients based on insomnia symptoms could improve patient health outcomes. These innovative clinical trial designs could help pipeline products distinguish themselves from products that have similar MOAs.