Precision and personalised medicine (PPM) is the stratification of patients within a disease segment using their genomic and phenotypic variations to find targeted therapies.

This is an alternative to the traditional drug design process, which typically has a one-size-fits-all approach. Although the concept that patients presenting similar symptoms may respond differently to the same medical intervention is historic, PPM is an emerging approach.

It has already begun reshaping disease treatment paradigms and transforming patient outcomes for rare genetic diseases and, most predominantly, cancers. Most leading marketed PPM therapies are designed for oncology indications. The development of these targeted therapies has prolonged the survival of patients with breast, lung, colorectal, melanoma and haematological malignancies.

The success of PPM is undeniable; according to GlobalData’s Sales and Forecasts database, sales for PPM therapies were $8b in 2022. This is projected to reach $106 billion by 2029, growing at a compound annual growth rate (CAGR) of 44% as the increased utilisation of artificial intelligence (AI) in healthcare significantly increases the demand for PPM; this convergence of AI and PPM is set to revolutionise healthcare.

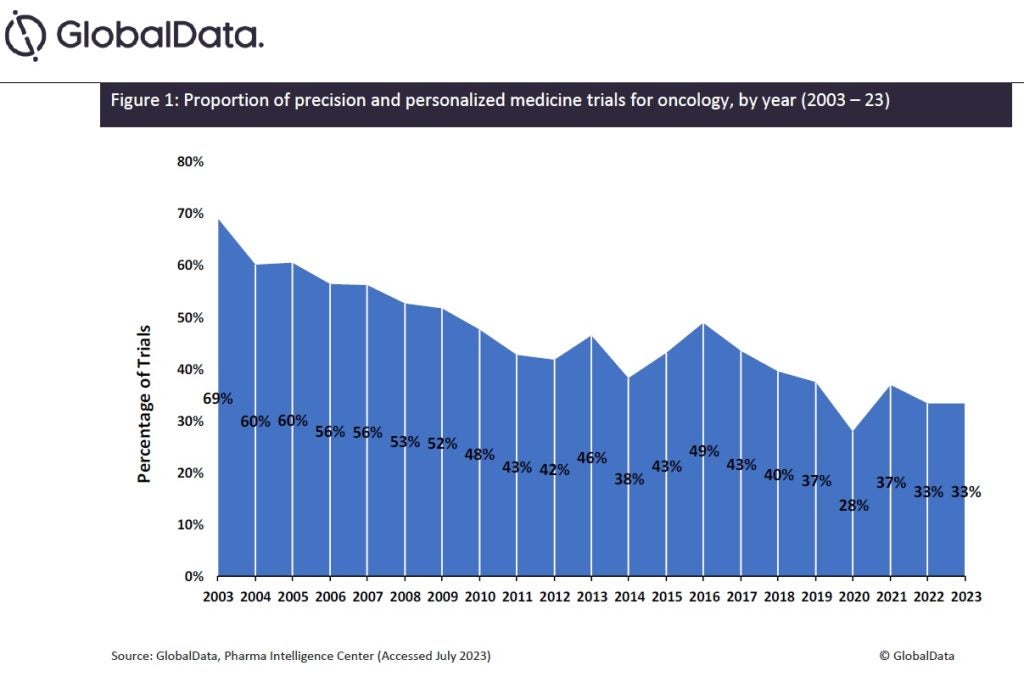

Sponsors have observed the success of PPM within oncology and have begun implementing these strategies in other therapy areas. Data obtained from GlobalData’s Trials Intelligence module reveals that the proportion of PPM trials for oncology indications has decreased by more than half over the last two decades, from 69% to 33% (Figure 1), showing funding is being distributed beyond oncology.

Many therapeutic areas such as the central nervous system (CNS) and musculoskeletal disorders, have highly heterogenous patient populations, making them ideal candidates for PPM approaches. It is possible that sponsors have recognised this opportunity, as GlobalData’s Clinical Trials database indicates that the proportion of CNS PPM trials has increased fivefold over the last two decades, from 2.3% in 2003 to 11.5% to date in 2023, with five months remaining.

Advancements in technologies such as blood-based diagnostics for CNS disorders have created new opportunities to stratify patient populations, enabling the progress of PPM therapies within the field. Similarly, the proportion of PPM trials for musculoskeletal disorders has increased 3.4 times, from 2.3% in 2003 to 7.9% in 2023. Musculoskeletal research has been enriched by a wealth of new discoveries derived from the human genome project that was responsible for creating new opportunities in PPM through gene therapies.

It is vital that pharmaceutical companies continue to invest in PPM, serving therapy areas beyond oncology, as these strategies are becoming increasingly critical to the successful treatment of other diseases. However, PPM therapies are expensive to produce and mostly benefit rare indications; this restricted market size makes it difficult for sponsors to achieve a return on investment, which is why the therapy areas represented in PPM trials have been restricted. Hopefully, as the PPM market size reaches its projected value, the cost of producing PPM therapies will be reduced, allowing the unmet needs of patients beyond oncology to be thoroughly addressed.