According to GlobalData’s Clinical Trials Database, among clinical trials for 2022, Phase II led with 40.1% of trials. This was followed by Phase I (28.8%), Phase III (25.4%), and Phase IV (15.4%). Q1 2022 had the greatest number of trials with 26.8%, followed closely by Q2 2022 with 26%.

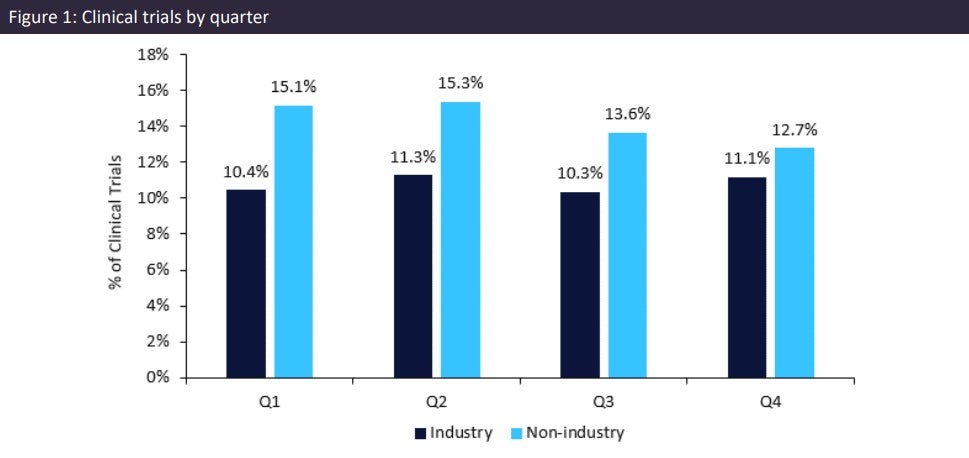

Overall, non-industry-sponsored trials outnumbered industry-sponsored trials at 56.9% versus 43.1%, respectively. For Q1 to Q4, the number of industry-sponsored trials remained nearly level. However, non-industry trials steadily decreased for Q3 and Q4. Compared to 2021, there was no sharp increase in the number of industry-sponsored trials. This could be due to the reduced investment from company sponsors after the Covid-19 pandemic.

Phase I trials accounts for 40.7% of trials in China, compared to 37.5% in 2022. Phase II dominates trials in India with 51.7%, followed closely by the US at 44.5%. Iran leads Phase III trials with over 60.1% of trials. Most of these trials investigated the central nervous system, followed by women’s health and infectious diseases. Iran was one of the few Middle Eastern nations with the capacity to develop therapeutics and vaccines. India had the highest proportion (19.4%) of trials in Phase IV. This was closely followed by China at 17.6%. Like previous years, this could be attributed to India’s rule that drugs approved in the UK, EU, Australia, Canada, Japan, or the US no longer need clinical trials in India, which expedited drug approvals and removed large study requirements.

However, pharmaceutical companies still need to conduct Phase IV trials after the drug had been marketed to gather post-marketing surveillance and real-world evidence, as well as to evaluate long-term effects.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData