Changes in the geography of clinical trials have been exacerbated by recent geopolitical events. As the shift gathers momentum, emerging pharmaceutical markets are presenting areas of opportunities for sponsors and their contract research organisations (CROs) and contract manufacturing organisations (CMOs).

As part of an article series, Oximio examines the factors influencing the shift in the clinical trial map, followed by a current assessment of the impact of the war on trials in Ukraine and practical advice for sponsors looking to alternative trial locations as a result.

Clinical research by volume of studies is still dominated by the established pharmaceutical markets. In Europe in 2020, 178,941 trials were started and, per country, more trials took place in the USA than in China, Japan and Germany (the three runners-up) combined.

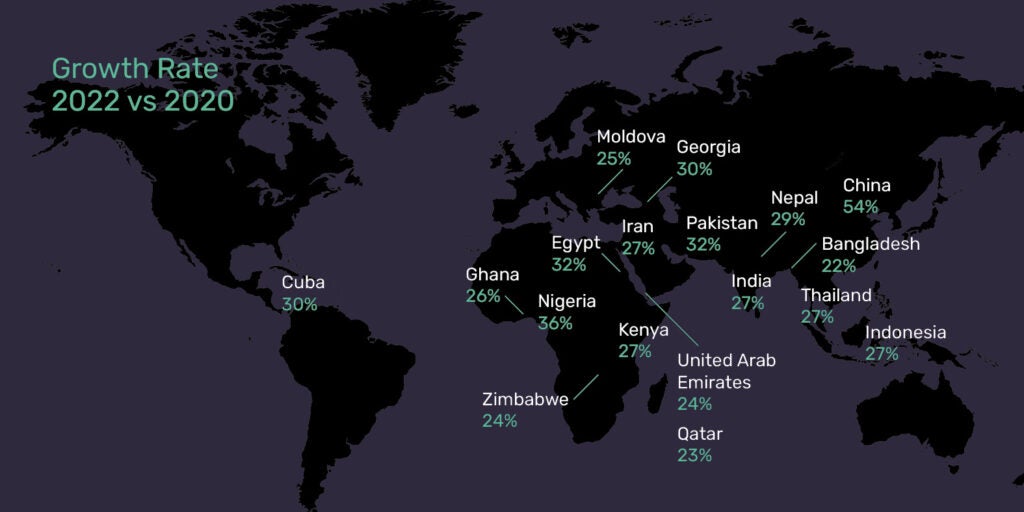

However, the rate of growth in emerging markets is outpacing that of the established markets, with Asia Pacific, the Middle East, and Africa demonstrating the biggest gains over the past decade. In the last two years alone, nearly 20 countries in these regions have seen double-digit growth in their number of studies.

Why the clinical trial map is changing

With a focus on expediting trials, improving data collection, and lowering cost per patient, the following factors are just some that have contributed to the growth rate increases in emerging pharmaceutical markets.

Competitive enrolment: Sponsors focus carefully on the disease burden per country, available potential patient pool, and cost per patient to ensure the most cost and process-efficient recruitment processes.

Legislation: The adoption of standardised directives and regulations, for example the harmonisation of GCP by the ICH ensures the maintenance of quality standards across countries and regions.

Decentralised trials enabled by technology: Decentralised trials increased 50% year-on-year between 2020 and 2021 according to GlobalData analysis. Accounting for just 9% of clinical trials in 2015, the spread of mobile healthcare, wearable devices, and web-based technologies meant remote research made up 30% of the total in 2021 and continues to gather pace. The result is the inclusion of a greater number of countries per study, to cover broader patient populations.

Health crises: Covid-19 and regional epidemics like Ebola have necessitated an increase in studies (and corresponding focus on target patient population) for infectious diseases.

Macroeconomic events: While the UK will always remain an important player from a health economics point of view, Brexit, and the implications for sponsors in terms of duplicating processes and requirements across the EU and UK, is likely to have an impact on country selection in study start-ups going forward.

Read more: Russia’s war in Ukraine