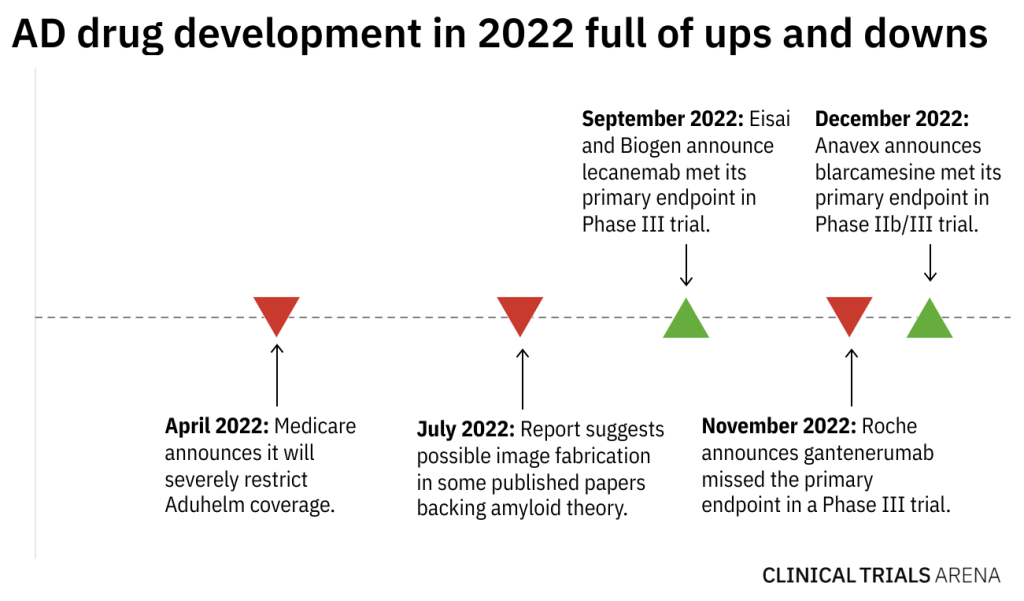

In Alzheimer’s disease (AD) drug development, the past year has been a rollercoaster ride, complete with two successful late stage trials, a key Phase III miss, and a crushing blow to Biogen’s Aduhelm. So what happened in 2022, and what does this mean for sponsors riding into 2023?

Looking back, 2022 brought two key successful Phase III trials. In September, Eisai and Biogen announced lecanemab met its primary endpoint of slowing the rate of cognitive decline in a 1,906-patient Phase III study (NCT03887455). Just last week, Anavex announced blarcamesine met its primary endpoint of slowing decline in a 509-patient Phase IIb/III trial (NCT03790709).

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, 2022 was also full of bumps and controversies. In November, Roche announced its antibody, gantenerumab, missed the mark in the Phase III GRADUATE-1 (NCT0344397) and GRADUATE-2 (NCT03444870) studies. Meanwhile, Medicare announced in April it would severely restrict coverage of Aduhelm, shattering the sales prospects of what analysts once believed to be a multi-billion dollar drug. And over the summer, a report suggested data manipulation in studies backing the amyloid theory behind most current AD therapies.

As sponsors work to make sense of 2022, here’s a look at three major questions that could shape AD drug development in 2023.

Will Lilly’s donanemab break through?

Just three months ago, the AD field was eagerly anticipating four major AD drug trial readouts in 2022 and 2023. Since then, three of the trials have released results, leaving all eyes are on Eli Lilly’s antibody donanemab.

As it stands, Eisai’s and Biogen’s lecanemab is set to become the market-leading monoclonal antibody for treating AD, following Aduhelm’s market flop and gantenerumab’s unsuccessful Phase III trial. But in Q2 2023, Lilly expects results for the 1,800 patient TRAILBLAZER-ALZ 2 study of donanemab (NCT04437511). The question is, will donanemab match or surpass lecanemab?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOverall, the results for the lecanemab trial were modest, with treatment patients declining by 0.45 points less than placebo over 18 months along the Clinical Dementia Rating–Sum of Boxes (CDR-SB). CDR-SB is a validated 18-point scale that measures decline in cognition and function.

Meanwhile, TRAILBLAZER-ALZ 2’s primary endpoint is the integrated Alzheimer’s Disease Rating Scale (iADRS), which combines two validated endpoints measuring cognition and daily function in AD. However, Phase II donanemab data had some experts worried the drug’s benefits were only marginal.

Will AD trials become more inclusive?

Diversity and inclusion have been common refrains in the drug development space in 2022, but Alzheimer’s disease trials have lagged starkly behind.

In the US, research suggests Black older adults are up to twice as likely to have AD or dementia than white older adults. Yet most major AD drug trial that report on race, including Phase III studies of Aduhelm and ganterumab, fail to enroll significant numbers of Black patients. In fact, among the US patients enrolled in the two Phase III trials of ganterumab, only 3% were Black—a notable underrepresentation of the actual US population.

While only Roche has released detailed demographic data sorted by country, overall diversity numbers that have been released in other late-stage Alzheimer’s trials are similarly concerning. As the AD field moves into 2023, expect heightened scrutiny over the lack of diversity in clinical trials. Already, Medicare updated coverage criteria for amyloid-targeting antibodies in AD to include specific requirements for participant diversity in response to growing concerns.

Will there be new approaches to AD drug development?

The amyloid theory, which holds that reducing amyloid-beta plaque accumulation in the brain could slow or stop AD progression, has been the driver of most recent AD therapeutic approaches—including donanemab, lecanemab, ganterumab, and Aduhelm. Most AD funding and research is heavily invested into the amyloid theory due to longstanding support from prominent experts, the neurologist Dr George Perry has told Clinical Trials Arena.

However, a Science article in July suggested possible data manipulation in key studies supporting the amyloid theory, prompting subsequent investigations. But many experts see the positive lecanemab trial as a validation of the amyloid theory, begging the question: will this approach continue to dominate AD drug development?

Amyloid is currently the most common target in the entire AD pipeline, including preclinical candidates, according to GlobalData’s Clinical Trial Database. However, approaches like acetylcholinesterase (ACHE) inhibitors and N-methyl-D-aspartate receptors (NDMAR) antagonists are slowly gaining steam. GlobalData is the parent company of Clinical Trials Arena.

While late-stage results for donanemab will likely catch the most headlines, the targets chosen for early-stage clinical activity in AD could reveal where the field is ultimately headed.

Takeaways:

- Results for Lilly’s donanemab in Q2 2023 will determine whether Eisai’s and Biogen’s lecanemab retains its status as the likely market-leading antibody for AD. But questions over the clinical magnitude of lecanemab’s and donanemab’s benefit still loom large.

- The AD field has lagged behind other indications in the effort to promote more inclusive trials. Blowback over the lack of diversity in key recent AD trials likely means sponsors will be under added scrutiny to recruit more diverse studies going forward.

- Amyloid buildup remains the most common target in the AD drug pipeline. However, the targets sponsors choose for new AD therapies in 2023 and new clinical data will show the field’s long-term confidence in the anti-amyloid approach.