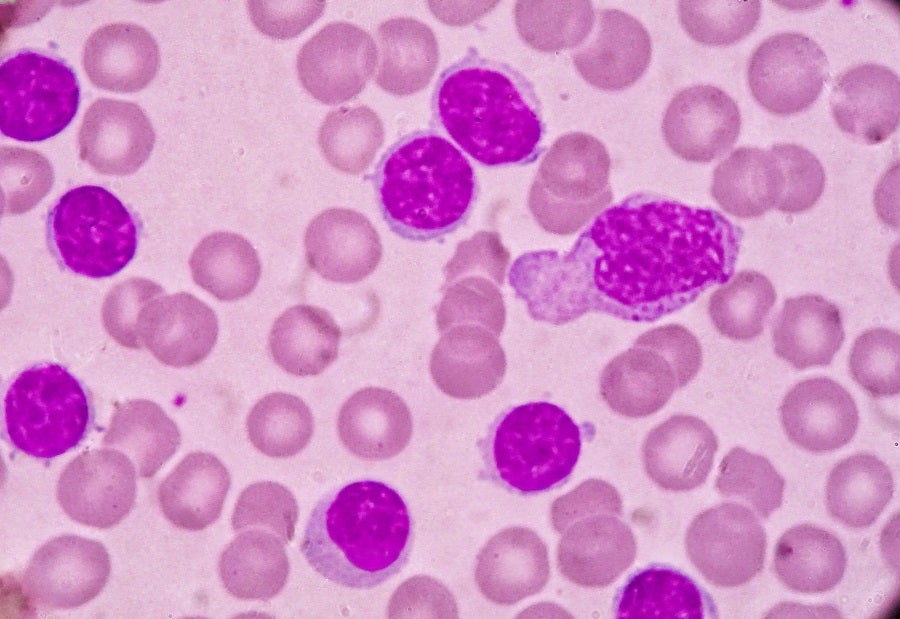

Chronic lymphocytic leukaemia (CLL) is one of the most common blood malignancies, with a diagnosed prevalence of more than 250,000 patients in the US and a median survival time of more than ten years from diagnosis. The survival time has been steadily increasing, as has prevalence as a function of survival, due to improvements in the management of the disease.

Small lymphocytic lymphoma (SLL) is considered the same disease as CLL, with the only difference being the primary site of the cancer; hence, it follows the same treatment paradigm. Newly diagnosed patients are typically treated with a combination of anti-CD20 antibody and either a Bruton’s tyrosine kinase (BTK) inhibitor or AbbVie’s/Roche’s Venclexta (venetoclax), or sometimes treated only with single-agent BTK inhibitor. Upon relapse, the main preferred option is a single-agent BTK inhibitor, which, however, relies on whether (and as part of which regimen) the patient received a BTK inhibitor in the first line.

BTK inhibitors are very effective but have been plagued by toxicity that leads to high discontinuation rates. So far, AbbVie’s/Janssen’s Imbruvica (ibrutinib) and AstraZeneca’s Calquence (acalabrutinib) are BTK inhibitors with a broad FDA label for all CLL populations. BeiGene’s Brukinsa (zanubrutinib), despite being recommended in the National Comprehensive Cancer Network Guidelines and having received approval in the EU, has not received FDA approval yet.

At the 64th American Society of Haematology (ASH) Annual Meeting and Exposition on 10–13 December, new data were presented from the randomised Phase III ALPINE study of Brukinsa versus Imbruvica (abstract [SP1] #LBA-6). The study enrolled 652 relapsed/refractory (R/R) CLL patients who received a median of one previous line of therapy and were randomised 327 to receive Brukinsa and 325 to Imbruvica. Patients who received BTK inhibitors previously were excluded. The primary endpoint was overall response rate (ORR). The ORR by an independent review committee (IRC) was 86.2% for Brukinsa versus 75.7% for Imbruvica.

At a median follow-up of 29.6 months, in the intention-to-treat population, the progression-free survival (PFS) assessed by IRC was not reached for Brukinsa versus 35 months for Imbruvica (hazard ratio [HR]: 0.65). While a median overall survival (OS) analysis has not been performed yet, the comparison favours Brukinsa at an HR of 0.76. The treatment discontinuation rate was lower for Brukinsa, at 15.4%, versus 22.2% for Imbruvica. Brukinsa also demonstrated an improvement in cardiac toxicity, with no Grade 5 events compared to six events for Imbruvica.

Head-to-head comparisons for drugs of the same class are rare due to the risk of failure to demonstrate superiority, and with this data, BeiGene’s high-risk choice was rewarded. Calquence has previously been compared to Imbruvica in high-risk R/R patients in the Phase III ELEVATE-RR trial, but was only able to demonstrate non-inferiority and a lower rate of adverse events.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThese results establish Brukinsa as the most attractive option for BTK-inhibitor-naïve R/R CLL patients and a marketing authorisation from the FDA is expected by next month. While the trial has not demonstrated whether patients live longer with Brukinsa versus Imbruvica, the substantially improved PFS and the lower toxicity leave no arguments in favour of Imbruvica. This assessment could only change in favour of cost, when ibrutinib generics become available, and only as long as an OS advantage is not demonstrated.

Given that AbbVie has previously stated that ibrutinib generics are not expected to come into the market until at least 2030, Imbruvica cannot be supported in the R/R setting as a cost-effective option, given its current premium pricing, comparable to Brukinsa and Calquence. GlobalData’s drug sales database forecasts peak sales of $3.1bn for Brukinsa worldwide by 2028, and with this data, this figure could increase further.